Our team of planners, infrastructure experts, and business analysts have developed smart city schemes in Asia, Africa, and the Middle East.

OHK’s HQ in San Francisco, continuously ranked in the top 5 smart cities globally, works with the world’s most innovative smart city solution providers. © OHK Consultants.

Information and Communications Technologies (ICT) are reshaping the 21st century. Ubiquitous ultra-high-speed access to ICT services promises to transform urban fabrics into smart and productive cities as did the car in the 20th century. Any city, new, emerging, or mature can compete globally by integrating all-encompassing ICT infrastructure. City administrators and developers are rethinking urban services to retain a competitive edge. ‘Smart’ solutions are increasingly pushing partnerships that create value across a city’s economic sectors and urban chains.

But what is a smart city?

Is it an oasis of world-leading technology?

Does it use ICT infrastructure to enhance the lives and welfare of residents and visitors alike?

Does it provide world-leading innovative services to businesses and consumers?

Does it manage the built environment to respond to changing conditions?

Does it enhance the quality of life and the environment?

Does it tap into all sectors integrating services within, for example, healthcare, education, and e-government?

The answer is all the above.

And it does so through a technology backbone that can maintain wide accessibility and sustainable affordability. To wit, it is accessible from any location, indoors and outdoors, in homes and offices, within a single building and across tens of blocks of buildings, in open areas and public spaces, and in networked systems such as transport, energy and utilities.

Meanwhile, it must be competitive through marketable bundles and tiers that meet various demand and price points. So, a balancing act of interests between municipal decision makers, infrastructure investors, and ICT operators can place the consumer at the heart of marketability and give value to all those involved in delivery.

OHK Consultants has been at the forefront of smart city developments in Dubai from the early beginnings. At the inception of projects such as the Downtown Dubai, Dubai Marina, and the Palm Islands, we helped formulate the operational and value-sharing frameworks under which the city municipality, real-estate master developers and ICT service providers operate. Photo shows Downtown under construction in 2008. © OHK Consultants.

If smart infrastructure is a win-win with both value creation and low-cost delivery, a city’s ambition does not stop at access. It goes all the way to game-changing innovation. OHK estimates that smart infrastructure can contribute 1-3% of GDP per capita growth in emerging markets and economies in transition. The multiplier effect of smart city provisions cannot be underestimated. Capitalizing on large developable land inventories will boost economic productivity, enhance multiple service economies, and support land and real-estate values.

All-encompassing ICT infrastructure has become the hallmark of new cities such as Songdo in Korea and Dubai in the UAE. Major conurbations such as Singapore have quickly responded by planning their transformation into smart cities. Also, the ‘ICT-retrofitting’ of existing services is now a given in every e-government and ICT strategy in the Gulf, from Oman to Qatar. In redevelopment plans, efficiency in services, from smart energy grids and distribution networks is integral to Africa’s new master plans such as Konza in Kenya. The same can be said about non-oil economies of the Middle East and emerging Europe where donors and IFIs are pushing smart street lighting and building efficiency as instruments of city regeneration from Cairo to Kiev.

OHK Consultants helps municipalities and developers map their involvement in the value chain of city-smart services and define the role they could take up and the services to offer. © OHK Consultants.

OHK has been involved in the above initiatives, and helped clients own a stake in the smart city revolution. It starts with identifying sources of value and uniquely positioning them to capture the opportunity. We work from the inception of ideas and as early in the master planning process as possible to grandfather smart city considerations in the founding vision. In various cityscapes, we have mapped institutional and partnership frameworks for how different parties can effectively work together—developers, builders, and municipal providers be it in utilities, transport or even security services.

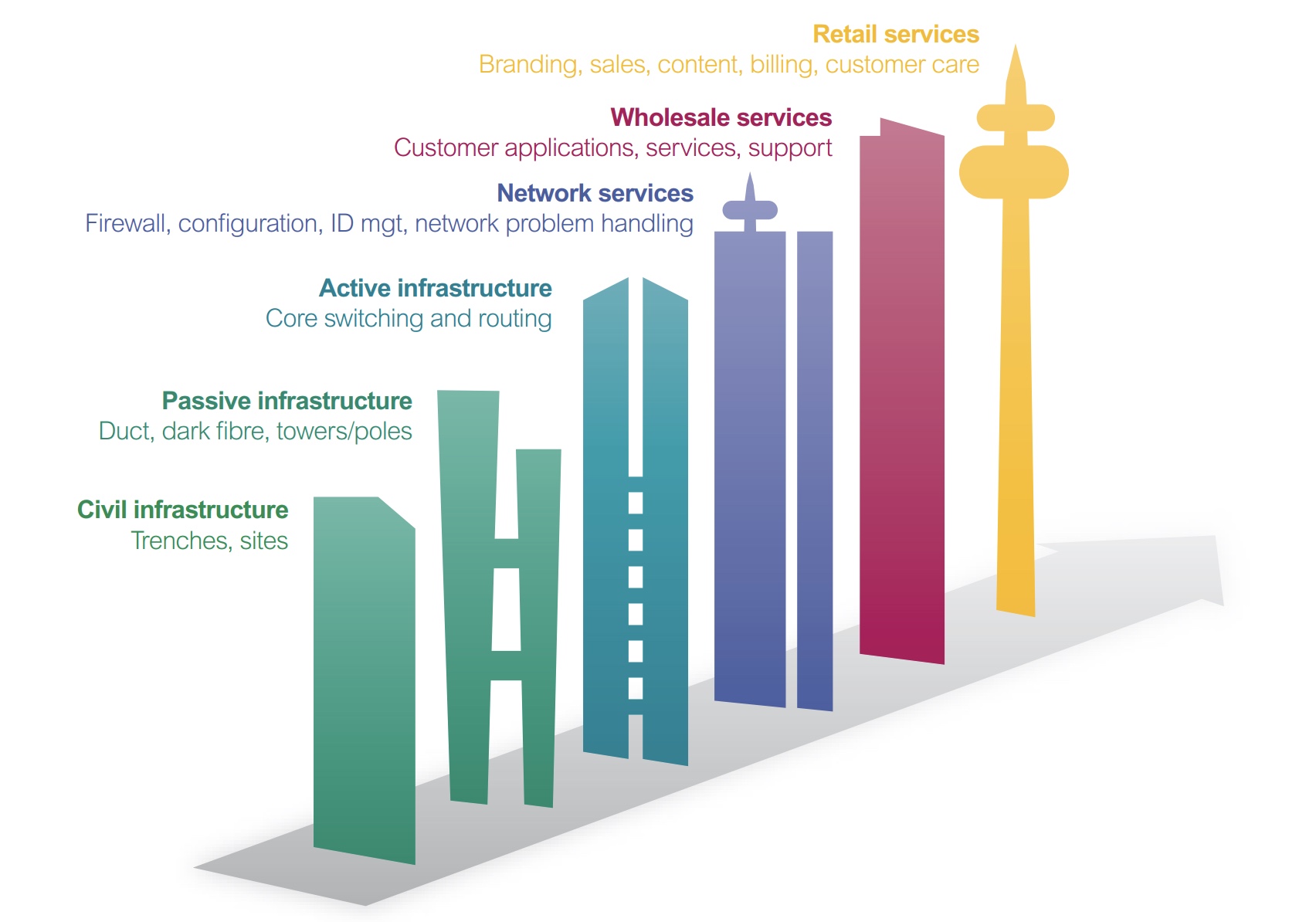

Municipalities often deploy civil infrastructure but do not have the expertise in-house to install and manage ICT infrastructure required to support smart services. The figure above shows the role of a city administrator or infrastructure provider can assume across any urban value chain. Through option studies, we enable a better understanding of the window of opportunity and help draft city frameworks for building and retrofitting infrastructure. A “sharing” vision not only requires technical scoping to reduce costs of reverse-engineering but also methods of deployment.

A team from OHK Consultants worked with the Saudi government to conceptualize a smart city plan for Neom, the future 26,500 sq. km city in the border region of Saudi Arabia and Egypt. We modeled the city’s GDP from the ground up and built forecasts of the value contribution of smart city services as part of a PPP arrangement between the two countries and international smart city vendors. © OHK Consultants.

A city may generally be discouraged to go further downstream in ‘smart servicing’, particularly when it’s challenged with urban congestion, weak transportation modes, outdated regulation, and mounting deficits. It is often easier not to move beyond the implementation of civil infrastructure especially when a mature market of partnerships with service and technology suppliers can offer a range of business models to match each city’s appetite for risk and reward. Therefore, it is important to set smart strategies in a way to best suit a certain position based on competitive advantage, financial capabilities, risk mitigation, and the dynamics of regulatory and market conditions.

Increasingly, we are helping cities push the envelope and move beyond their physical asset base towards getting involved in value-adding technology provisions. There is a greater role for municipalities to go beyond deploying infrastructure to delivering services to end users or to retail service providers. Most recently, we helped a master-planned city own a stake in their smart services’ market with the view on holding a position worth $ 2.4 USD Billion a year, per a city GDP of $ 80 USD Billion. We modeled various options and provided scenarios of financial positions taken or desired and recommend the technical scope for long-term viability.

In today’s globalized market of ICT infrastructure, OHK has close relationships with leading smart city vendors, and we continuously help guide the best G2B deal options that can fit a certain regulatory environment and strike joint ventures that are low on risk and appropriate for public-private partnerships (PPPs).

Please contact us for our case studies on leading smart cities, London, New York, San Francisco, Seoul, and Dubai, and learn more about our work in emerging markets and smart city PPPs.