The Political Economy of Carbon Markets: How Incentives, Institutions, and Market Design Shaped Integrity Challenges and Credibility Gaps

OHK examines how incentive structures and institutional design fundamentally shaped carbon markets’ credibility, behavior, and long-term integrity outcomes.

As carbon markets expanded under global climate agreements, financial incentives increasingly shaped how emissions were measured, valued, and traded, with money flowing faster than scientific verification and governance could adapt, turning climate mitigation into a negotiated marketplace where assumptions, audits, and credit volumes often carried more weight than real atmospheric outcomes, revealing how political economy, institutional design, and weak digital integrity systems combined to blur the line between environmental action and financial optimization.

This article is part of a four-part blog series on carbon markets, climate accounting, and the digital infrastructure shaping global decarbonization efforts. This Part I explores how climate ambitions evolved into market-based carbon systems, examining the incentives, institutional roles, and design choices that structured early carbon finance mechanisms. Part II, The Modern Carbon Economy: Fragmented Markets, Digital MRV Expansion, and the Growing Crisis of Trust in Carbon Accounting, assesses the current landscape of carbon markets and the credibility challenges facing both compliance and voluntary systems. Part III, The Infrastructure Gap in Carbon Accounting: Why Carbon Software Platforms Digitize Workflows Instead of Building Systems of Trust, analyzes why most digital carbon tools fail to address structural integrity issues. The final piece, Part IV, Designing Carbon Infrastructure for Integrity and Scale: A Systems Architecture for Verifiable Data, Governance, and Trusted Carbon Markets, outlines OHK’s full-stack approach to building credible carbon infrastructure, which remains part of our proprietary consulting stack in this domain. Refer to Part II here and Part III here.

In essence, this is a key part of OHK’s structural trilogy on carbon:

• Part I — Carbon Markets: Incentive architecture and economic distortion

• Part II — Carbon Accounting: Measurement systems, technology scaling distortions, digital MRV, and modeled emissions

• Part III — Carbon Infrastructure: Software architecture built around processes rather than systems, institutional governance design, and programmable integrity

Reading Time: 35 min.

All illustrations are copyrighted and may not be used, reproduced, or distributed without prior written permission.

Summary: Part I explores how carbon markets were shaped by financial incentives, rapid scaling pressures, and institutional priorities that prioritized transaction volume over long-term integrity. It examines the emergence of offset mechanisms, baseline methodologies, and credit issuance frameworks that unintentionally encouraged inflated reductions, weak additionality, and credibility gaps. By unpacking the political economy behind early carbon market design, the article shows why many of today’s trust challenges were not failures of execution but structural outcomes embedded within incentive systems from the start.

Born from multilateral negotiations and economic compromise, carbon accounting transformed atmospheric pollution into quantifiable, tradable units, enabling nations to reconcile climate ambition with growth and competitiveness, as global agreements translated emissions into financial instruments measured in tons of CO₂e, allowing industrialized countries to finance reductions abroad rather than restructure domestic systems, establishing a common accounting language that mobilized capital at scale while embedding reliance on modeled baselines and negotiated assumptions at the very foundation of climate governance.

Origins of Carbon Accounting: From Global Diplomacy to Quantified Emissions

Kyoto Protocol foundations, Baseline Emissions Logic, and Birth of Offset Mechanisms.

Carbon accounting emerged in the late 1990s as governments sought a politically acceptable response to climate change under the United Nations Framework Convention on Climate Change (UNFCCC). The fundamental why was economic and diplomatic. Countries wanted emissions reductions without slowing growth or imposing uniform constraints. The how became the translation of pollution into measurable units that could be compared, priced, and exchanged. This was formalized in 1997 through the Kyoto Protocol, which introduced quantified emissions targets and tradable reduction units. The where was global, but implementation concentrated in industrialized countries purchasing reductions from developing economies. The when aligned with rising globalization and financial market sophistication.

For example, industrialized countries such as Germany, the United Kingdom, and Japan were legally allowed to meet part of their emissions reduction obligations by purchasing carbon credits generated in developing economies instead of cutting emissions domestically, which in practice meant European utilities and manufacturers financed wind farms in Inner Mongolia, methane capture projects in Chinese coal mines, and industrial gas destruction facilities in India, with each project converting “avoided emissions” into standardized tradable units that could be counted toward national climate targets, clearly illustrating why the system was designed to preserve economic competitiveness, how pollution was transformed into a financial asset, where implementation concentrated in emerging markets, and when it scaled rapidly after 2005 alongside globalization and financial market growth, successfully mobilizing large volumes of private capital while failing to ensure that many reductions were truly additional or permanently climate-beneficial and relying almost entirely on manual reporting, consultants, and audits rather than digital verification infrastructure.

Baseline emissions projections became the technical backbone of the system. Instead of measuring actual atmospheric outcomes, projects compared future hypothetical emissions against post-project scenarios. This modeling approach allowed flexibility and scalability but embedded assumptions at every stage. What worked was rapid mobilization of international capital and the creation of a common accounting language for emissions. What did not work was the reliance on counterfactual modeling as a proxy for real climate impact, which proved inherently contestable and vulnerable to manipulation. For example, large industrial gas destruction projects in China and India calculated their carbon credits by establishing hypothetical baseline scenarios showing continued high emissions of potent greenhouse gases such as HFC-23, then comparing those projections to post-project emissions after installing destruction equipment, which meant that millions of credits were issued based not on measured atmospheric change but on modeled assumptions about what pollution “would have been” without intervention, a structure that successfully created a standardized accounting language that unlocked massive private investment flows very quickly, but also failed because baseline projections were often overstated, making projects appear far more climate-beneficial than reality, leading later reviews to conclude that many of these facilities were already economically viable and likely to reduce emissions anyway, demonstrating how counterfactual modeling enabled scalability while simultaneously making the system highly vulnerable to manipulation and credibility loss in the absence of continuous digital verification.

Software was not conceived as infrastructure at this stage. Accounting occurred through spreadsheets, manual verification reports, and document-based audits. The system assumed human oversight rather than continuous digital verification, planting early limits on transparency and scalability. During the early 2000s, there was no centralized digital MRV platform, no real-time data infrastructure, and no automated validation systems, with most carbon accounting instead handled through Excel spreadsheets, PDF monitoring reports, email submissions, and periodic on-site audits by consulting firms, while registries functioned largely as simple transaction databases that recorded credit ownership rather than verifying environmental reality, meaning that project developers manually calculated baselines, verifiers reviewed documents every few years, and regulators approved credits based on paper trails rather than live data streams, which worked in the short term by enabling rapid scale across hundreds of projects and countries using familiar administrative tools, but failed to provide transparency, continuous oversight, or systemic fraud detection, embedding a model of climate governance built on human judgment and static documentation rather than software-driven integrity, a limitation that later became critical as markets expanded in size, complexity, and financial stakes.

In essence, the early climate architecture succeeded in answering how emissions could be transformed into measurable and comparable units, creating a technical foundation that made global coordination possible, but it did so by relying on modeled baselines and counterfactual projections rather than direct environmental outcomes, which allowed rapid scaling and standardization while embedding uncertainty and manipulation risk at the core of the system, meaning that carbon accounting functioned less as a scientific measurement infrastructure and more as a financial abstraction layer designed to enable tradable instruments. Origins of Accounting → How are emissions measured? → Technical foundation.

As climate policy evolved into market architecture, emissions reductions were transformed into tradable financial assets, allowing governments and corporations to reconcile regulatory pressure with economic efficiency, as carbon credits priced in tons of CO₂e flowed from developing-world projects to industrialized buyers, mobilizing private capital at unprecedented scale while reshaping environmental action into a global commodity system where financial liquidity, project volume, and cost minimization increasingly guided climate intervention.

The Rise of Market-Based Climate Action: From Environmental Policy to Carbon Finance

Clean Development Mechanism Logic, Public vs. Private Crediting, and Institutional Hosts.

The Kyoto framework evolved into operational markets through mechanisms such as the Clean Development Mechanism, which allowed projects in developing countries to generate tradable carbon credits. The why was to reduce global mitigation costs while channeling investment toward cleaner development paths. The how involved certifying emission reductions from specific projects and allowing industrialized nations to purchase them to meet legal targets. The where quickly concentrated in China, India, Brazil, and other emerging economies where large industrial and energy projects could generate high volumes of credits. The when peaked between the early 2000s and 2012, during Kyoto’s first commitment period.

China became the single largest supplier of carbon credits in the world during the 2000s by registering thousands of Clean Development Mechanism projects, particularly large wind farms, hydropower dams, and industrial energy efficiency facilities, where each project quantified emissions reductions against approved baselines and converted them into tradable certified emission reductions that were purchased by European utilities and governments to comply with their climate targets, clearly demonstrating why the system aimed to cut global costs by financing cheaper reductions abroad, how project-level certification transformed local infrastructure into financial assets, where activity clustered in fast-growing emerging economies with large emissions profiles, and when the market scaled most aggressively between 2005 and 2012, successfully mobilizing billions of dollars into renewable energy deployment while also favoring large industrial projects capable of producing massive credit volumes over smaller community-scale climate solutions, revealing how market efficiency drove capital quickly but skewed investment toward scale rather than equitable or transformational development.

Institutions including the World Bank created carbon finance funds, supported project pipelines, and helped scale the market. Carbon rapidly became a financial asset class. What worked was the speed of market formation, the attraction of private capital, and the mainstreaming of emissions as an economic variable. What did not work was the transformation of climate mitigation into a volume-driven commodity market, where financial returns increasingly overshadowed environmental integrity. For example, the World Bank launched multiple carbon finance facilities in the early 2000s such as its Prototype Carbon Fund, which pooled public and private investor capital to purchase carbon credits from projects across China, India, Latin America, and Eastern Europe, financing renewable energy plants, landfill methane capture, and industrial efficiency upgrades while guaranteeing buyers a steady stream of certified emission reductions for compliance markets, effectively turning emissions reductions into a tradable financial product that could be bundled, priced, and managed like other investment assets, which worked by rapidly attracting institutional investors, accelerating project pipelines, and creating liquidity in newly formed carbon markets, but failed by incentivizing project developers to prioritize high-volume credit generation and fast certification over long-term decarbonization impact, leading capital to concentrate in large industrial installations that maximized returns rather than in systemic transitions such as grid reform or structural energy efficiency, illustrating how carbon shifted from a climate policy tool into a commodity market where financial optimization often overshadowed environmental integrity.

Digital systems again played almost no structural role. Registries existed mainly as transaction logs, not as real-time verification platforms. Monitoring reports were periodic, manual, and heavily document-based. Carbon markets were built like early financial markets without modern digital clearing or continuous auditing. Throughout the peak years of the Clean Development Mechanism between roughly 2005 and 2012, carbon registries functioned primarily as simple electronic ledgers that recorded issuance, ownership transfers, and retirement of credits, similar to early stock settlement databases, while all core measurement and verification continued to rely on periodic PDF monitoring reports, spreadsheet-based calculations, consultant site visits, and manual approval workflows, meaning that a wind farm in China might submit emissions data once every one or two years for review before credits were issued in bulk rather than being continuously monitored, which worked by enabling international trading and preventing double-counting at a basic transactional level, but failed to provide real-time transparency, automated anomaly detection, or continuous assurance of environmental performance, effectively reproducing a paper-based regulatory system inside digital folders rather than building true climate data infrastructure, and leaving carbon markets technologically closer to 1990s financial clearing systems than to modern digitally audited platforms.

In essence, once emissions were converted into standardized accounting units, the system effectively answered how those units could be transformed into a global marketplace, enabling industrialized countries and private actors to buy, sell, and trade reductions across borders, which successfully mobilized capital at unprecedented speed and embedded carbon into financial systems, but in doing so shifted climate action into a commodity framework where scale, liquidity, and transaction volume became central drivers of behavior. Market Creation → How are units traded globally? → Financialization.

As carbon credits became monetized per ton of CO₂e, project developers and investors increasingly optimized for credit volume, baseline positioning, and price signals rather than long-term decarbonization impact, transforming emissions reductions into performance metrics shaped by financial modeling, spreadsheets, and market expectations, where rising charts signaled profitability more clearly than atmospheric change, revealing how incentive structures, once standardized and tradable, gradually redirected climate action toward revenue maximization and measurable output rather than systemic environmental transformation.

Incentive Design and Unintended Outcomes: When Financial Optimization Replaced Climate Impact

Payment for Volume Not Impact, Additionality Distortions, and Project Selection Bias.

The core incentive of carbon markets rewarded the number of credits generated, not the durability or systemic value of emissions reductions. The why was simple. Credits needed to be standardized and tradable to create liquidity. The how was direct payment per verified ton of carbon dioxide equivalent reduced. The where favored large industrial projects and infrastructure developments capable of producing millions of credits efficiently. The when coincided with rapid private sector entry into carbon finance during the 2000s. For example, during the rapid expansion of carbon markets in the mid-2000s, industrial gas destruction projects at chemical plants in China and India became some of the most profitable carbon ventures in the world because they could generate millions of credits annually from a single facility, with companies paid directly for every ton of highly potent greenhouse gases such as HFC-23 eliminated, even though installing the destruction equipment itself was relatively inexpensive compared to the enormous revenue from carbon credits, clearly showing why standardized per-ton payments created liquidity and investor interest, how direct monetization of reductions rewarded sheer volume over structural transformation, where capital flowed toward large centralized industrial sites rather than dispersed low-carbon transitions, and when private equity and energy firms rushed into carbon finance during the 2005–2012 boom, successfully achieving rapid emissions accounting at scale while distorting incentives so severely that the system created incentives that risked increasing production of polluting gases in order to maximize credit generation, revealing how financial optimization overtook climate impact as the dominant market logic.

Additionality became the central gatekeeper concept, requiring proof that a project would not have happened without carbon revenue. In practice, proving this counterfactual scenario was deeply subjective. Numerous studies later showed that many projects, particularly large hydroelectric dams and industrial gas destruction facilities, were already financially viable. What worked was rapid scaling and private sector participation. What failed was environmental credibility, as credits were frequently issued for reductions that were likely to occur anyway. Many large hydroelectric dams in China, Brazil, and Southeast Asia were approved for carbon credits on the basis that carbon revenue was necessary to make them financially viable, even though government planning documents and investor filings later showed that these projects were already part of national energy expansion strategies and would have been built regardless of carbon finance, while similarly industrial gas destruction facilities claimed additionality despite extremely high profit margins from selling credits, leading independent academic reviews and policy audits to conclude that a substantial share of issued credits did not represent truly extra emissions reductions, which worked in mobilizing massive private sector participation and accelerating market scale, but failed in environmental integrity by rewarding projects that were already economically attractive, demonstrating how additionality became a subjective narrative exercise rather than a verifiable economic test and allowed the system to grow quickly at the cost of genuine climate impact.

Software was still absent as a governance tool. There were no automated checks for financial viability, baseline plausibility, or systemic risk. Verification relied on consultants, auditors, and paperwork, making the system slow, opaque, and prone to strategic framing. Still, there were no automated digital systems capable of independently testing whether a project was financially viable without carbon revenue or whether its baseline projections were statistically plausible, meaning that additionality assessments were conducted through consultant-written investment analyses, spreadsheet sensitivity models, and narrative justification documents reviewed periodically by designated operational entities, while regulators relied on static submissions rather than integrated financial databases or real-time cross-project analytics, which worked in enabling global participation using conventional audit and compliance practices familiar to development finance institutions, but failed to detect systematic patterns such as repeated overestimation of baselines or structurally profitable projects claiming financial necessity, and even today although registries and MRV tools are more digital, automated cross-market economic plausibility testing and systemic risk detection remain limited, showing that software has improved transaction efficiency far more than governance intelligence.

In essence, with carbon fully financialized, the market ultimately revealed how actors respond when environmental performance becomes a revenue stream, as project developers optimized for credit volume, baseline inflation, and project types that maximized returns rather than long-term decarbonization impact, demonstrating that once standardized emissions units were monetized, behavioral distortion became structurally inevitable, transforming climate mitigation from a systemic transition challenge into a high-throughput commodity production model. Incentives → How do actors behave under monetization? → Distortion.

As carbon valuation depended on hypothetical baseline scenarios rather than measured atmospheric change, emissions accounting evolved into a negotiated technical process where modeling assumptions, revised methodologies, and projected growth trajectories directly shaped credit volumes and financial returns, transferring uncertainty and risk from project developers to buyers, and turning measurement frameworks into economic instruments through which small analytical adjustments could generate large revenue outcomes, blurring the boundary between scientific estimation and market-driven optimization.

Measurement as a Political and Economic Tool: How Baselines Became Negotiated Assets

Baselines as Negotiable Assumptions, Methodology Inflation, and Risk Transfer to Buyers.

Carbon markets depended on hypothetical baselines projecting what emissions would have been in a world without intervention. The why was methodological necessity, since real-world counterfactuals cannot be directly observed. The how involved economic modeling, growth projections, and sector-specific assumptions. The where varied across industries such as energy, manufacturing, and land use. The when evolved continuously as methodologies were revised and expanded under regulatory bodies. For example, within energy and industrial projects approved under the Kyoto mechanisms, coal-fired power plants that were never actually built were frequently used as hypothetical baseline scenarios to estimate what emissions “would have occurred” without a renewable energy project, allowing wind farms or hydropower facilities in China and India to claim extremely large emissions reductions by comparing themselves to high-emission fossil fuel alternatives rather than to more realistic grid expansion trends, while in manufacturing sectors developers modeled rapid industrial growth trajectories to inflate future pollution pathways, which clearly shows why baselines were necessary for accounting but inherently hypothetical, how economic assumptions directly translated into credit volume, where the practice spread across energy, industry, and infrastructure sectors, and when methodologies were repeatedly revised as developers sought more favorable projection frameworks, successfully enabling standardized comparisons across diverse project types but failing by turning emissions measurement into a negotiation over assumptions rather than an objective reflection of climate reality, making carbon outcomes highly sensitive to modeling choices instead of actual environmental performance.

Because credit volumes depended on baseline assumptions, methodology design became economically consequential. Developers were incentivized to propose higher projected emissions trajectories to increase future reductions. Oversight bodies attempted standardization, but sector complexity and lobbying pressure made consistency difficult. What worked was the creation of technically sophisticated accounting frameworks capable of comparing vastly different project types. What failed was the transformation of emissions measurement into a financial negotiation space where modeling choices directly influenced revenue. For example, under methodologies approved through the UNFCCC, HFC-23 destruction projects at chemical plants in China generated more than 500 million certified emission reductions by 2012, representing billions of dollars in market value, even though the actual cost of installing and operating destruction equipment was often estimated at only a few million dollars per plant, because baseline scenarios assumed continued high-volume emissions of this extremely potent greenhouse gas for many years into the future, allowing developers to claim enormous “avoided” pollution simply by altering production processes, while in the power sector renewable projects frequently compared themselves to hypothetical coal plants with emissions factors far above actual grid averages, which in some cases doubled or tripled credited reductions per megawatt hour, clearly demonstrating how baseline inflation directly increased revenue, why methodology assumptions became economically strategic, and where oversight struggled to enforce consistency across sectors, successfully producing a technically unified accounting framework capable of comparing factories, dams, and wind farms, but failing by turning emissions modeling into a high-stakes financial negotiation where small assumption changes created hundreds of millions of dollars in additional credits, fundamentally shifting carbon measurement from scientific estimation toward revenue optimization.

Digital infrastructure again lagged behind system complexity. There were no integrated modeling engines, anomaly detection tools, or transparent public data layers. Methodologies lived in static documents rather than programmable rule systems. Nothing had changed. Major project types, such as industrial gas destruction, grid-connected renewable energy, and manufacturing efficiency, were published as long PDF methodology documents often running hundreds of pages, with developers manually applying formulas in spreadsheets to project emissions trajectories over ten to twenty years, while validators reviewed these models case by case without access to centralized data engines, cross-project analytics, or automated plausibility checks, meaning that there was no integrated modeling software to test whether projected growth rates were realistic, no anomaly detection to flag outlier baselines generating unusually high credits, and no transparent public data layer to compare similar projects across countries, which worked in the short term by allowing highly flexible sector-specific accounting frameworks to evolve quickly, but failed as system complexity exploded, turning carbon governance into a patchwork of static documents and consultant judgment rather than programmable rule systems capable of systemic oversight, leaving markets technologically closer to regulatory paperwork than to modern data infrastructure even as credit volumes and financial exposure soared.

In essence, once hypothetical baselines became the foundation of carbon valuation, emissions measurement shifted from scientific estimation into economic negotiation, as modeling assumptions and methodological choices directly determined financial returns, incentivizing developers to optimize projections rather than reflect real-world dynamics, demonstrating that when counterfactual scenarios are monetized, technical uncertainty becomes a revenue lever, ultimately transforming carbon accounting from a climate integrity tool into a financial construct shaped by assumptions instead of atmospheric reality. Baselines → Monetization of assumptions → Strategic modeling behavior → Distorted climate measurement

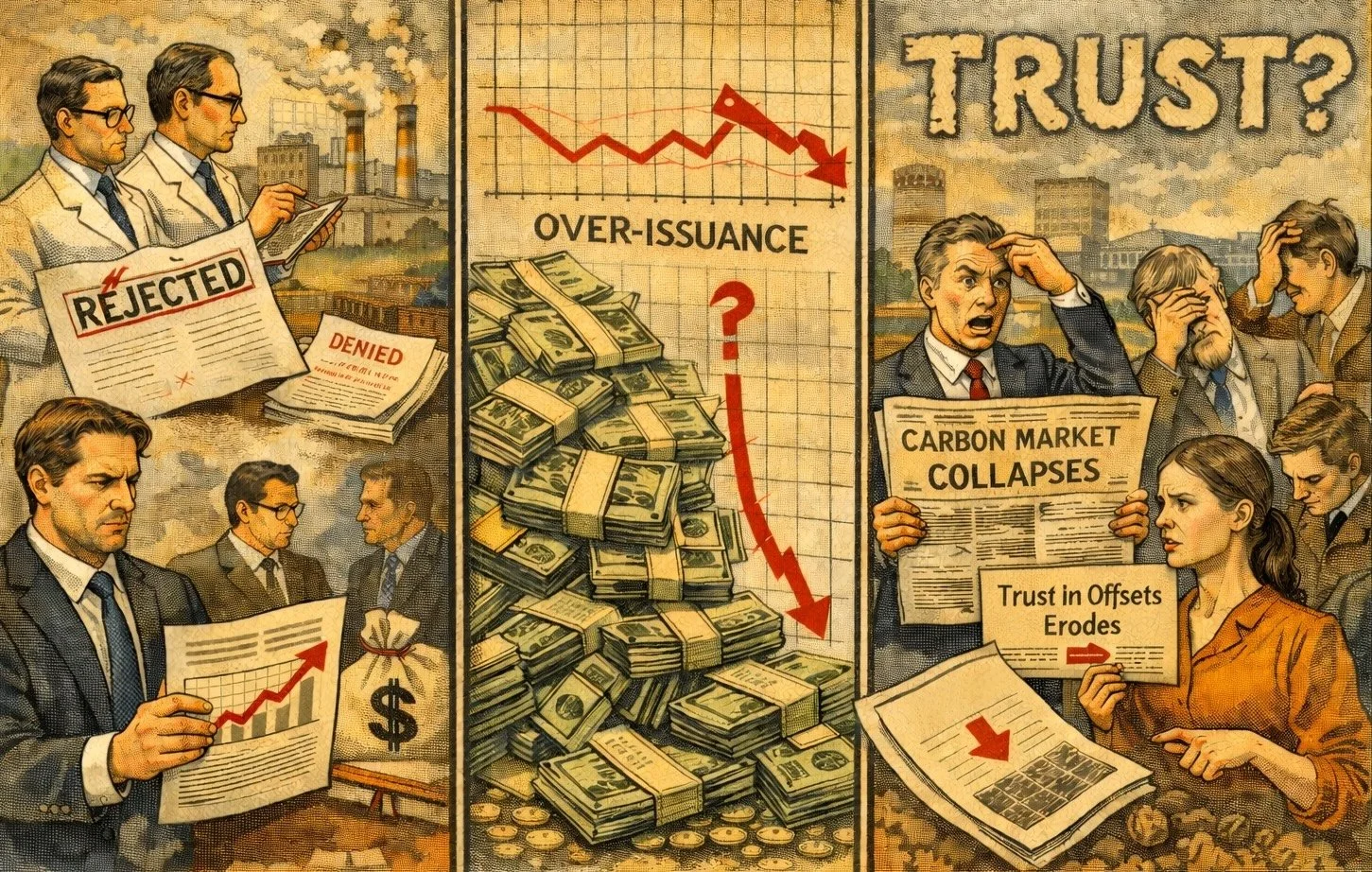

As inflated baselines and weak additionality produced an oversupply of carbon credits, market prices collapsed under the weight of excess issuance, exposing the gap between traded emissions reductions and real climate impact, while rejected methodologies, regulatory tightening, and growing buyer skepticism pushed integrity concerns into public view, transforming what had once been a rapidly scaling climate finance mechanism into a credibility crisis where trust in offsets eroded faster than markets could adapt.

Early Warning Signs: Oversupply, Market Collapse, and Trust Erosion

Rejected Methodologies, Over Issuance, and Trust Erosion

By the early 2010s, cracks in the system became visible. The why was growing evidence that many credits lacked real environmental impact. The how appeared through academic reviews, regulatory scrutiny, and buyer skepticism. The where was most evident in compliance markets tied to Kyoto mechanisms, particularly in Europe. The when accelerated after 2012 as demand for certified emission reductions collapsed. Growing academic and regulatory evidence showed that large volumes of carbon credits delivered little or no real environmental impact, particularly within mechanisms operating under the UNFCCC. Studies examining Clean Development Mechanism projects found that a significant share, especially industrial gas destruction and large hydropower facilities, would likely have been built regardless of carbon finance, undermining additionality claims. European regulators and corporate buyers began questioning credit quality as investigative reports revealed inflated baselines and weak verification across multiple sectors. This credibility erosion was most visible in European compliance markets, which had been the largest buyers of CDM credits. The tipping point came after 2012, when Kyoto’s first commitment period ended and confidence in offset integrity sharply declined.

Credit prices fell dramatically, signaling oversupply and declining confidence. Questions around additionality, baseline inflation, and project credibility moved into mainstream climate policy debate. What worked was the demonstration that global carbon markets could exist at scale. What failed was long-term trust, environmental certainty, and institutional robustness. The market response was swift and severe. Certified emission reduction prices collapsed from over €20 per ton in the mid-2000s to less than €1 by 2013, reflecting massive oversupply and shrinking demand. Hundreds of millions of unused credits flooded the market as regulators restricted eligibility and buyers pulled back. Debates over additionality, baseline inflation, and methodological manipulation moved from academic journals into mainstream climate policy reform discussions. Governments acknowledged that while the system had successfully proven that international carbon markets could scale rapidly and mobilize billions in capital, it had failed to ensure that credited reductions consistently represented real, durable climate benefits. What worked was market creation at global scale. What failed was trust, environmental certainty, and long-term institutional credibility.

Software still functioned only as record-keeping rather than system integrity infrastructure. Registries tracked ownership but did not validate reality. Monitoring remained episodic. Transparency depended on reports rather than live data. Throughout this unraveling, software remained largely administrative rather than systemic. Carbon registries continued to function as electronic ownership ledgers, recording issuance and transfers but offering no validation of emissions reality. Monitoring still occurred through periodic consultant reports, site inspections, and spreadsheet submissions rather than continuous data streams. There were no integrated analytics to flag implausible baselines, detect abnormal credit volumes, or compare similar projects across regions in real time. Transparency depended on static documents rather than live public data infrastructure. Even as markets handled billions of dollars in environmental assets, digital governance remained closer to document management than to modern verification systems, limiting early detection of systemic risk and credibility breakdown.

In essence, once structural weaknesses accumulated across incentives, measurement, and verification, carbon markets revealed the consequences of scaling financial instruments faster than governance capacity, as oversupply exposed inflated baselines, weak additionality, and fragile trust, demonstrating that without real-time integrity infrastructure, market volume inevitably outpaced environmental credibility, turning early success in mobilization into systemic instability. Rapid scaling → Credit oversupply → Credibility collapse → Market trust erosion.

While mainstream finance and corporate operations had already adopted real-time digital systems, automated controls, and continuous data verification, carbon accounting remained rooted in spreadsheets, static methodologies, and document-based audits, creating a structural gap where sophisticated financial markets operated atop fragile integrity infrastructure, revealing that the credibility crisis of carbon markets stemmed not from lack of available technology, but from the failure to treat software as core governance architecture rather than administrative support.

Digital Sophistication Elsewhere, Analog Fragility Here: The Technology Gap in Carbon Accounting

When Markets Scaled Before Infrastructure: The Digital Governance Failure of Carbon Accounting.

By 2012, mainstream financial and corporate accounting systems had already undergone deep digital transformation, with enterprise resource planning platforms such as SAP and Oracle enabling real-time ledgers, automated controls, and integrated risk analytics across global operations, while stock exchanges deployed algorithmic trading systems and banks implemented continuous compliance monitoring that flagged anomalies instantly, demonstrating that the broader financial ecosystem had embraced programmable governance, structured data pipelines, and system-level verification, yet carbon markets operating under mechanisms linked to the UNFCCC remained largely dependent on spreadsheets, PDF methodology documents, and periodic consultant audits, revealing a stark divergence between financial digitization and climate accounting infrastructure.

In addition, by the late 2000s and early 2010s, many corporations had already implemented Environmental Management Systems (EMS) aligned with ISO 14001 standards, administered under the International Organization for Standardization, which required structured data collection, continuous performance monitoring, internal audits, corrective action tracking, and management review cycles, meaning that environmental performance was no longer handled through ad hoc reports but through centralized digital platforms that logged emissions, resource use, incidents, and compliance actions in real time, demonstrating that scalable environmental data governance already existed well before carbon markets reached maturity, and offering a ready-made operational model for how climate data integrity could have been embedded systemically rather than administratively.

Within these EMS platforms, companies tracked energy consumption, waste streams, water usage, regulatory compliance, and environmental risks through integrated dashboards and automated workflows, often linking sensor data, operational logs, and audit trails into unified systems that could be reviewed continuously by management and external certifiers, which meant that anomalies triggered alerts, trends were analyzed dynamically, and documentation was generated automatically from live data rather than retroactively assembled, showing that environmental accountability had already entered the digital governance era, while carbon accounting paradoxically remained trapped in spreadsheet modeling and periodic narrative reporting, illustrating that the technology gap was not about capability but about institutional design choices.

To repeat again, in carbon systems, baselines were calculated manually using Excel models, monitoring reports were submitted every one to three years, and validation relied heavily on narrative justifications reviewed by designated operational entities, meaning that there were no integrated modeling engines to stress-test baseline plausibility across projects, no automated cross-sector analytics to detect statistical outliers, and no systemic anomaly detection to identify patterns of over-crediting, even as billions of dollars in certified emission reductions were issued and traded internationally, illustrating that while carbon became fully financialized, its governance architecture never evolved into a true digital integrity system, leaving markets exposed to assumption-driven distortions that modern accounting software in other sectors had long been designed to prevent.

The lesson was quietly embedded in plain sight: environmental performance systems had already solved the problems of continuous monitoring, auditability, and data integrity that carbon markets later struggled with, yet policymakers and market architects failed to scale these digital governance principles into carbon infrastructure, choosing instead to build credit issuance systems around static methodologies and consultant verification, confirming that the credibility crisis was not due to technological immaturity but to the decision to financialize emissions before digitizing integrity, and that the tools for trustworthy climate data had existed all along, waiting to be elevated from corporate compliance into market-grade infrastructure.

The collapse of prices and credibility after 2012 exposed this technological lag, yet the institutional response largely focused on refining methodologies and tightening documentation requirements rather than building programmable infrastructure, so instead of embedding algorithmic plausibility checks, live data ingestion, or real-time verification layers, regulators added procedural complexity to an already document-heavy framework, demonstrating that the integrity crisis was not caused by lack of available technology, but by failure to treat software as core infrastructure, and confirming a central lesson of the era: when financial architecture scales faster than digital governance, trust erosion becomes structurally inevitable.

As carbon markets matured into financial exchanges, trading desks, price signals, and capital flows expanded rapidly, yet the governance, verification, and digital integrity systems designed to safeguard environmental credibility evolved far more slowly, creating a structural imbalance where financial momentum outpaced regulatory depth, and where the architecture of markets grew more complex and lucrative than the mechanisms intended to ensure that each traded ton of CO₂e represented real, durable climate impact.

Synthesis: When Financial Architecture Outpaced Governance and Integrity

Across the evolution of early carbon markets, a consistent structural pattern emerged. Economic efficiency and rapid capital mobilization were prioritized before institutional robustness, verification systems, and digital governance were in place. Baseline modeling transformed emissions into tradable assets, incentives rewarded volume over impact, and additionality relied on subjective counterfactuals rather than verifiable economic reality. While these design choices successfully created global markets almost from scratch, they simultaneously embedded vulnerabilities that scaled alongside capital flows. What began as a pragmatic diplomatic solution gradually evolved into a financial system where assumptions, projections, and consultant-driven audits determined environmental value.

As markets expanded, these weaknesses accumulated rather than corrected. Oversupply exposed inflated baselines. Credibility challenges undermined buyer confidence. Software remained largely administrative, unable to provide continuous verification, systemic risk detection, or real-time transparency. The result was not market failure in scale, but failure in trust and environmental certainty. Carbon markets proved they could mobilize billions quickly, but not that they could consistently deliver durable climate outcomes.

Policy ambition → Financialization of emissions → Incentive distortion → Measurement negotiation → Trust erosion.

Bridge to Part II: The modern carbon landscape did not emerge despite these early design flaws. It emerged because of them. Today’s fragmented registries, digital MRV tools, voluntary market controversies, and integrity debates are direct descendants of systems built for speed rather than systemic credibility. Understanding where carbon markets stand now requires first understanding how their foundations were constructed.

At OHK, we view the early evolution of carbon markets not as a story of failed climate ambition, but as a lesson in how financial systems scale faster than governance and digital integrity when infrastructure is treated as an afterthought rather than a foundation. The credibility challenges facing today’s carbon economy are not accidental. They are the structural outcomes of incentive design, institutional choices, and analog measurement frameworks embedded from the start. By understanding how carbon accounting evolved from diplomatic compromise into financial architecture without corresponding systems of trust, OHK approaches modern climate infrastructure as a full-stack challenge, where data integrity, governance, and scalable digital verification must precede market expansion rather than chase it.

At OHK, our work on carbon markets, climate accounting, and digital climate infrastructure is grounded in building real-world systems of integrity, not standalone software tools. We support governments, development institutions, and private-sector leaders in designing credible carbon accounting frameworks, full-stack digital MRV platforms, registry infrastructure, and governance mechanisms that enable transparent, scalable decarbonization. By combining institutional reform expertise with advanced data systems and software architecture, we help organizations move beyond fragmented reporting toward trusted climate infrastructure. If your organization is developing carbon accounting systems, engaging in carbon markets, or building digital climate platforms, contact us to explore how OHK can support the design and implementation of resilient, policy-ready carbon infrastructure.