The Future of Work in the Age of AI: Ten Forces Reshaping Organizations

How automation, intelligent systems, and new productivity models are fundamentally transforming jobs, corporate structures, workforce strategy worldwide, and introducing new systemic bubble risks across labor, technology, and capital markets.

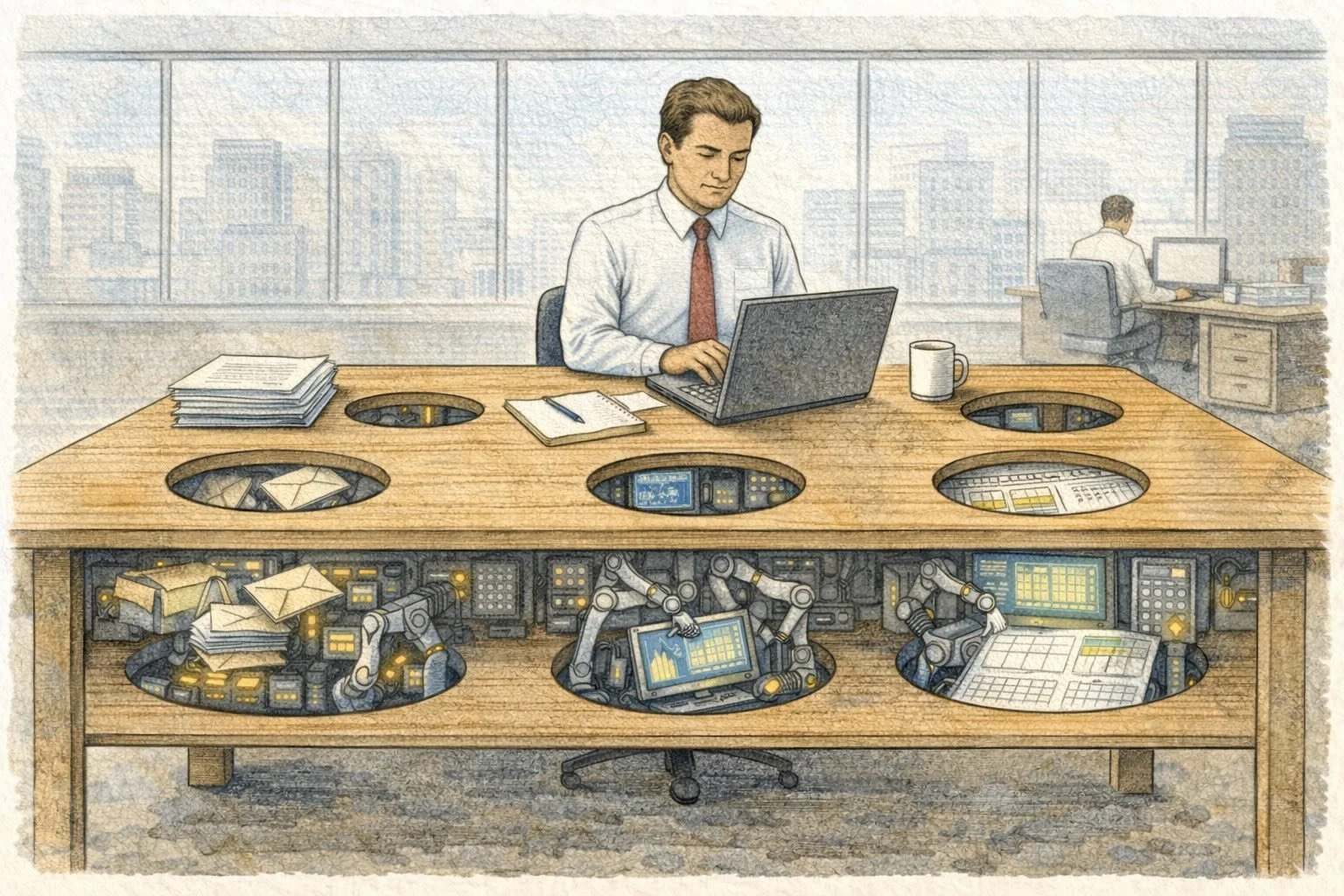

AI’s advance leaves visible job losses on the surface, while deeper structural shifts in how work is designed unfold quietly beneath.

This article is part of a three-part blog series on AI, layoffs, and the future of work. Part I, herewith, explores how artificial intelligence is redefining work itself and outlines the ten strategic forces driving organizational redesign and workforce transformation. Part II – Who AI Disrupts Most — and Who It Barely Touches examines sectoral and national differences in automation impact, including experience-based economies and emerging markets. Part III – Beyond Hype: Measuring AI’s Real Impact on Jobs introduces the analytical framework used to assess automation exposure across industries and economies. Refer to Part II here and Part III here.

Reading Time: 45 min.

All illustrations are copyrighted and may not be used, reproduced, or distributed without prior written permission.

Summary: Part I explores how artificial intelligence is fundamentally transforming the future of work, changing layoffs from traditional signs of financial trouble into strategic instruments of organizational redesign. It outlines ten key forces reshaping how companies operate, including the automation of routine tasks, the compression of management layers, the shift of resources from payroll toward digital infrastructure, and the emergence of new productivity models powered by intelligent systems. The article examines when workforce reductions genuinely support long-term efficiency and innovation, when they risk weakening execution and morale, and why thoughtful integration of AI, rather than simple cost-cutting, is what ultimately determines sustainable success in the modern economy.

Layoffs in the Age of Artificial Intelligence: Signal of Decline, or Blueprint for the Future of Work?

For most of modern corporate history, layoffs carried a fairly consistent message. They were either a distress signal—demand was falling, margins were under pressure, a business unit had failed—or a financial maneuver designed to reassure markets. Executives spoke of “right-sizing,” “efficiency,” and “synergies,” but investors and employees alike understood the subtext: something had gone wrong, or leadership was trimming costs to boost short-term earnings per share. A major downsizing announcement once implied weakness. It could temporarily lift stock prices, but culturally it suggested retrenchment rather than transformation.

Today, that meaning is shifting.

In the wake of rapid advances in artificial intelligence—particularly generative AI and automation tools that now touch writing, coding, analysis, customer service, design, and operations—layoffs are increasingly framed not as retreat, but as reinvention. Companies no longer present workforce reductions as emergency measures alone; they present them as strategic reallocations. Payroll is being converted into compute. Layers of management are being compressed into software. Repetitive workflows are being handed to algorithms. In earnings calls and press releases, a new narrative has emerged: layoffs are not just about cutting costs, they are about building the AI-driven organization of the future.

But beneath the messaging lies a more complicated reality.

Are these layoffs truly the result of AI replacing meaningful portions of human labor?

Are companies responsibly redesigning work around new technological capabilities?

Or is AI becoming the latest justification layered onto a familiar cycle of overhiring, restructuring, and market pressure?

More importantly: do these workforce reductions actually make economic and operational sense—or are they setting up the next wave of dysfunction? To understand what is happening, we need to examine both the data and the structural logic behind the new era of corporate layoffs. And beneath the transformation narrative sits a deeper question: are organizations redesigning work at the pace real productivity gains justify—or are hype, market signaling, and competitive fear fueling a bubble?

The Numbers: What We Know, and What We Don’t

What can be measured about AI-driven workforce change may only be the visible tip of a much larger transformation unfolding beneath the surface.

There is no single clean dataset that definitively tracks “AI-caused layoffs,” particularly within Fortune 500 companies. Workforce reductions are reported through press releases, regulatory filings, Worker Adjustment and Retraining Notification (WARN) notices in the U.S., earnings calls, and media coverage and companies often cite multiple reasons for the same action.

However, several trends are now clear. Since the release of widely accessible generative AI tools in late 2022, large corporations have announced hundreds of thousands of job cuts. Technology companies led the initial wave, but reductions have since spread across finance, consulting, retail, logistics, telecommunications, media, and manufacturing. Tracking firms such as Challenger, Gray & Christmas—which analyze corporate layoff announcements—have begun categorizing a subset of job cuts as explicitly tied to AI or automation. Their data suggests that AI-attributed layoffs now represent a measurable, though still minority, share of total workforce reductions. In some recent months, roughly 5–8% of announced layoffs have cited AI or automation as a driver.

Cumulatively since 2023, many in the U.S. alone have been publicly attributed to AI-related restructuring. Yet context matters. Workforce reductions tied partly to AI-driven restructuring have added up quickly across major U.S. firms; for example: Amazon eliminated roughly 16,000 corporate roles in 2026 following earlier tech and operations cuts linked to automation and AI efficiency pushes, and Meta Platforms reduced over 10,000 positions across 2023–2024 as it reoriented toward AI infrastructure and product development. Also, IBM phased out nearly 8,000 back-office and support jobs while expanding AI and automation across HR and IT functions, and Google cut more than 12,000 employees in 2023 with executives explicitly citing AI-driven productivity shifts and organizational streamlining. Outside of GAFAM — Google, Apple, Meta, Amazon, and Microsoft — UPS announced up to 30,000 job reductions by 2026 as automated sorting, route optimization, and AI-enabled logistics transformed operations. These examples illustrate how U.S. job losses have been publicly linked to AI-era restructuring even while broader cost control and market pressures remain key drivers.

The real story is not whether AI has “caused” all recent layoffs. The story is that AI has become the organizing logic through which companies are rethinking labor itself.

However, this is not the whole story of AI. In reality, the majority of layoffs still stem from post-pandemic over-hiring corrections, slowing growth in certain sectors, rising interest rates and capital discipline, and mergers and restructuring rather than AI alone. AI is not the sole cause of the current labor contraction. What is new is how frequently AI now appears in executive explanations—and how deeply it is shaping organizational redesign, workflow automation, and productivity expectations. At the same time, long-term projections from groups such as World Economic Forum, McKinsey & Company, and Goldman Sachs suggest that hundreds of millions of roles worldwide will be affected by AI over the next decade—with “affected” meaning not only eliminated, but transformed, augmented, or fundamentally restructured. In other words, many see the technological shock as real even if today’s layoffs reflect a blend of economic forces.

From Crisis Response to Strategic Redesign: How AI Is Changing the Meaning of Work

From labor to intelligent systems, organizations are rebuilding how work flows rather than eliminating it.

To appreciate how radical today’s shift in layoffs truly is, it helps to understand how workforce reductions have historically functioned inside organizations and how that meaning is now evolving in the age of artificial intelligence. For most of the modern corporate era, layoffs were fundamentally reactive. They were not tools of transformation, but responses to problems, often painful, sometimes necessary, and occasionally opportunistic.

The Old Model: Reactive, Not Proactive. For decades, workforce cuts generally fell into four broad categories. The first was demand shock. When revenues declined, orders slowed, or markets contracted, companies reduced payroll to stabilize costs. For example, in January 2026 U.S. employers announced 108,435 job cuts, the highest single month since 2009, with major firms like Amazon and UPS leading the tally amid slowing demand and contract changes. These cuts were tied to market conditions rather than transformative strategy.

The second category was operational failure. Projects collapsed, product strategies misfired, or expansions proved premature. In 2025, major tech companies including Microsoft, Intel, Google, and Meta collectively announced more than 100,000 job cuts as they adjusted after over-expansion and reprioritized product roadmaps, classic examples of layoffs following strategic missteps or shifting operational focus, with Meta’s reductions closely linked to scaling back its multibillion-dollar metaverse investments after disappointing returns and adoption.

A third driver was merger and acquisition synergies. After acquisitions, overlapping roles in finance, HR, IT, and operations were commonly eliminated. These reductions typically followed transactional logic rather than innovation logic. Finally, workforce cuts were sometimes financial engineering. Trimming payroll improved margins and earnings per share, occasionally triggering short-term stock price bumps. Analyses from 2025 observed that while tens of thousands of U.S. job cuts were attributed to AI, economists noted that only a fraction were genuinely due to technological substitution, with many reflecting traditional cost-discipline moves dressed in automation language. For example, the major workforce trims by Salesforce were widely linked to investor pressure to boost margins and stock performance, even as the company paired the cuts with efficiency and AI narratives.

Across all workforce reduction scenarios, layoffs historically followed disruption rather than shaped strategy. Even when framed as positive moves such as “right-sizing” or “streamlining,” they were responses to pressure including declining demand, failed initiatives, post-merger consolidation, or investor expectations, not proactive redesigns of how work itself was organized or delivered.

The New Model: Preemptive, Strategic, and AI-Framed. That historical context makes the contemporary narrative shift striking. In the era of artificial intelligence, workforce reductions are increasingly presented not as reactions to business stress, but as deliberate redesigns of operating models. Rather than responding to declining demand or failed initiatives alone, companies now frame layoffs as part of a strategic transition toward intelligent systems, automated workflows, flatter organizational structures, and reinvestment in technology infrastructure. This is not merely a change in language. It reflects a deeper shift in how business leaders justify and interpret workforce transformation.

Layoffs are now routinely linked to reallocating resources away from labor-intensive processes and toward cloud computing, data platforms, AI development, and automation tooling. Coordination layers are compressed as software increasingly handles reporting, scheduling, analysis, and operational oversight. Entire functions are being rebuilt around intelligent systems designed to scale output with fewer people.

As OHK summarizes the AI-driven shift: “Layoffs are no longer just a response to pressure; they have become a signal of how organizations are rewiring themselves around intelligence, automation, and radically different productivity models.”

Concrete examples illustrate this new framing clearly. When Amazon announced major workforce reductions in late 2025, leadership emphasized that more than 1,000 AI initiatives were underway across the organization and positioned the layoffs as part of reallocating capital and talent toward technology-driven operations rather than simple cost control. Even in non-Big Tech firms, Klarna, a global buy-now-pay-later and digital payments platform, tied workforce reductions and hiring freezes to the rapid deployment of AI-driven customer service systems, reporting that automated agents were handling a large share of customer inquiries while improving response times and efficiency.

Traditional industries are following similar paths. Pfizer linked workforce reductions in manufacturing and administrative functions to AI-enabled production planning following pandemic-era expansion, framing the shift as modernization rather than retrenchment. Siemens tied restructuring across engineering support and operations planning to AI-driven automation and digital twins now handling forecasting, maintenance scheduling, and process optimization.

Beyond these examples, AI-driven restructuring is increasingly visible across healthcare, finance, manufacturing, and logistics. UnitedHealth Group has automated large portions of claims processing and care coordination, enabling back-office workforce reductions. JPMorgan Chase has deployed AI across contract review, fraud detection, and operations, reporting millions of hours of human work saved annually. General Electric has tied workforce restructuring in maintenance planning and operations support to AI-powered predictive systems that optimize equipment performance and scheduling.

Together, these cases underscore a broader structural shift: AI-linked restructuring is not confined to Silicon Valley, regulated and physical-world sectors are actively redesigning workflows around intelligent systems, the earliest compression is occurring in administrative and planning functions, and layoffs are increasingly framed as modernization rather than distress.

From Reactive Cuts to Proactive Redesign—A Mixed Reality. Yet the logic behind this shift is not universally sound. Some organizations are genuinely redesigning work around AI in ways that fundamentally change productivity and operating structure, while others layer the language of AI transformation onto familiar cycles of cost discipline, overexpansion correction, and investor appeasement.

Across sectors, workforce reductions are framed as operating-model redesign, automation of labor-heavy processes, flatter hierarchies, and reallocation of spending toward technology infrastructure. However, the depth and authenticity of these changes vary widely by company and execution quality. For some, layoffs are part of real transformation toward higher-value work. For others, AI rhetoric overlays conventional restructuring goals.

This reframing fundamentally alters how investors, policymakers, employees, and leaders interpret layoffs. Once clear warnings of distress, workforce cuts are now often used to signal strategic direction and modernization. Yet distinguishing genuine transformation from linguistic repackaging of cost-cutting is essential for understanding the true future of work.

Beneath today’s layoff headlines, entire operating models are being quietly redesigned.

Ten Strategic Forces Behind AI-Era Layoffs—And When They Actually Make Sense

OHK has synthesized ten strategic forces through a structured analysis of corporate layoff announcements, executive communications, earnings call disclosures, automation investments, and operational redesign patterns across multiple industries and geographies. Rather than treating workforce reductions as isolated events, we examined the underlying business logic driving each decision, mapping where automation genuinely replaced workflows, where organizational structures were being redesigned, and where traditional cost discipline was being reframed as technological transformation. These themes represent the recurring mechanisms through which AI is currently reshaping labor economics in organizations, highlighting both where workforce compression is economically rational and where it risks becoming narrative-driven simplification. Together, they provide a practical view for leaders, investors, and policymakers to interpret AI-era layoffs not as headline events, but as signals of deeper operating-model change.

The analysis draws on observed restructuring across technology firms, financial institutions, healthcare providers, industrial manufacturers, and consumer services companies, incorporating both quantitative indicators such as workforce reduction volumes, automation investment levels, and productivity disclosures, as well as qualitative signals including strategic language shifts, workflow redesign initiatives, and post-layoff performance outcomes. By triangulating these inputs over the past several years of accelerated AI adoption, OHK was able to distinguish between layoffs driven by genuine automation-led transformation and those rooted in cyclical corrections or financial optimization. This approach ensures the themes reflect real operational behavior rather than theoretical automation potential, offering a grounded framework for understanding how AI is actually reorganizing work in practice.

Below, we synthesize five interconnected aspects across each of the ten strategic forces shaping AI-era layoffs. First, we examine the underlying economic and operational rationale driving each shift, clarifying why organizations pursue it and what business problem it is intended to solve. Second, we analyze the mechanisms through which change is implemented, whether through automation of specific workflows, organizational restructuring, capital reallocation, or redesign of accountability systems. Third, we assess where each force is most visible across sectors, functions, and types of work, highlighting the parts of the economy experiencing the greatest transformation pressure. Fourth, we interrogate what is often really occurring beneath the transformation narrative, distinguishing genuine operating-model change from traditional restructuring cycles reframed through AI language. Finally, we evaluate how each force is communicated to markets, employees, and stakeholders, and how that messaging shapes perceptions of modernization, efficiency, and strategic direction.

Across every theme, we then connect these five dimensions directly to four outcomes: (i) the evolving structure of work itself, (ii) the scale and pattern of layoffs being observed, (iii) the relative intensity of impact across industries and roles, and (iv) the degree to which each force may be amplifying narrative-driven expectations that risk fueling an AI bubble. This allows us to categorize whether each dynamic is producing high, medium, or low structural disruption, while also distinguishing between sustainable productivity transformation and momentum driven primarily by market signaling, hype cycles, or premature automation assumptions. In such environments, companies accelerate layoffs and automation initiatives not primarily because workflows have been demonstrably replaced, but because capital markets, peer behavior, and strategic rhetoric reward visible “AI transformation.” The result is a feedback loop in which workforce compression becomes self-reinforcing, often overshooting what productivity gains actually justify, leading to skill shortages, execution breakdowns, and the eventual need for rehiring or operational correction once reality catches up with expectations.

To stress-test each of the ten strategic forces behind AI-era layoffs, OHK applies a structured bubble-lens approach that examines where expectations, investment behavior, and organizational change may be accelerating beyond proven operational reality. Across each theme, we assess exposure to multiple bubble dynamics, including technology expectation bubbles where AI capabilities are overstated, productivity perception bubbles where efficiency gains are assumed before being measured, investment bubbles where capital flows outpace returns, hiring and restructuring bubbles where workforce expansion or compression overshoots economic fundamentals, and capital market signaling bubbles where narrative momentum drives strategic decisions. This framework allows us to distinguish sustainable transformation from hype-driven momentum that risks correction.

To summarize, OHK’s framework is essentially a three-layer way of understanding AI-era future of work, moving from surface events (who is cutting jobs) to deep structural forces (why it’s happening) to sustainability risk (whether the pace and narrative are overshooting reality). In Layer One: Strategic Forces—What Is Actually Driving Layoffs, this layer identifies the strategic forces shaping workforce reductions in the age of AI. Instead of treating layoffs as isolated corporate decisions or short-term cost reactions, this layer asks a deeper question: what recurring mechanisms are consistently showing up across companies, industries, and geographies? In simple terms, Layer One explains what patterns are repeatedly driving AI-era layoffs, moving the discussion beyond headlines toward systemic change.

In Layer Two: Structural Analysis—How Each Force Works in Practice, this layer dissects each strategic force to understand how it actually operates inside real organizations and why it leads to workforce compression. Here, each theme is examined across several concrete dimensions: (i) why companies pursue it economically, (ii) how they implement it operationally, (iii) where it appears most strongly across sectors and functions, (iv) what is genuinely changing versus what is being reframed rhetorically, and (v) how it reshapes work structures and layoff patterns. In practical terms, Layer Two explains the mechanics behind layoffs—not just that they happen, but how automation, redesign, incentives, and messaging combine to produce them.

In Layer Three: Bubble Lens—Whether the Change Is Sustainable or Inflated, this layer acts as a stress test. It asks whether each strategic force is progressing at a pace supported by real productivity gains and operational outcomes—or whether narrative momentum, market incentives, and fear of falling behind are accelerating change beyond what fundamentals justify. This is where multiple bubble dynamics are evaluated: (i) technology expectation bubbles (overestimating AI capability), (ii) productivity perception bubbles (assuming efficiency before proving it), (iii) investment bubbles (capital racing ahead of returns), (iv) hiring and restructuring bubbles (workforce changes overshooting need), and (v) signaling bubbles (strategic decisions driven by market reaction). This layer does not argue that AI transformation is false. Rather, it distinguishes sustainable modernization from hype-driven compression that risks later correction. In simple terms, Layer Three answers whether layoffs reflect real progress or inflated momentum.

1) AI Shifting Corporate Spending from Human Labor to Digital Intelligence Infrastructure

Workforce spending is giving way to long-term investment in automation and digital intelligence.

One of the most common rationales behind AI-era layoffs is the deliberate reallocation of resources away from payroll and toward technology investment. Companies are committing massive capital to cloud infrastructure, proprietary AI systems, data engineering, cybersecurity, and automation platforms, arguing that workforce reductions free funding to build scalable, intelligence-driven operations. When AI meaningfully replaces large volumes of routine work, redirecting spending from people to technology can raise long-term productivity and margins simultaneously. OHK sees this most clearly in organizations where automation absorbs repetitive workflows end-to-end rather than merely augmenting human effort. However, the logic breaks down when technology costs escalate faster than labor savings. AI systems require constant retraining, compliance oversight, cybersecurity protection, and infrastructure expansion. Replacing people with software is rarely a one-time cost reduction; it is a permanent operating expense shift.

Organizations pursue this shift primarily to convert variable labor costs into scalable technological leverage, investing heavily in cloud systems, AI platforms, and data architecture while reducing recurring payroll obligations. This transformation occurs most visibly in digital operations, finance, customer service, and software-heavy environments where workflows can be automated end-to-end. What is often really happening is a permanent rebasing of cost structures toward technology spend, even though this spend grows continuously rather than tapering off. Externally, companies frame this as “future-proofing operations” and “building AI-first platforms,” signaling modernization to investors. The impact on the future of work is high, as routine digital labor steadily disappears, driving sustained layoffs in process-heavy functions.

A clear example is Amazon, which told investors it would cut about 14,000 corporate roles while pointing to AI adoption as part of a broader operating-model reset, with Andy Jassy noting, “We will need fewer people doing some of the jobs… and more people doing other types of jobs.” A second, non-platform example is HP, which announced 4,000–6,000 job cuts by 2028 explicitly as it “ramps up AI efforts,” positioning the move as funding productivity and innovation through AI adoption rather than simply trimming costs. Key market message: “We are reallocating toward AI capacity.” What may really be happening: a permanent cost rebasing from labor to ongoing compute and platform spend.

This theme is moderately to highly bubble-prone because large capital flows into AI infrastructure often race ahead of proven productivity returns, creating investment bubbles where compute spending grows faster than operational value. It also fuels a productivity perception bubble, as firms assume technology investment will automatically justify permanent labor reduction even when workflows remain supervision-heavy. A mild restructuring bubble emerges when payroll is cut before systems stabilize. The risk is not that AI lacks value, but that cost structures are rebased on expectations rather than measured performance, mirroring historical technology investment booms that required later correction.

Now applying a bubble-risk lens, this theme most strongly engages an investment bubble, as capital rapidly flows into AI infrastructure, cloud computing, and automation platforms often ahead of proven operational returns. It also fuels a productivity perception bubble, where firms assume technology spend will automatically justify permanent labor reduction even while workflows remain supervision-heavy and integration costs continue rising. A mild restructuring bubble can emerge when payroll is cut faster than systems mature, rebasing cost structures on expectations rather than measured efficiency. The future-of-work impact is high, as routine digital labor is steadily replaced by permanent technology-intensive operating models.

2) AI Compressing Management Structures and Organizational Layers Through Automation of Coordination and Oversight

As coordination moves to software, organizations quietly remove the middle rungs — leaving flatter structures where work flows faster, but with fewer steps in between.

AI tools increasingly automate reporting, scheduling, performance tracking, documentation, and resource planning once handled by layers of middle management, triggering widespread de-layering initiatives. The strategic argument is that fewer organizational layers improve speed, accountability, and cost efficiency. When automation genuinely reduces coordination friction, flatter structures can unlock faster execution and clearer decision rights. OHK finds that this works best in digitally mature firms with redesigned workflows rather than legacy processes simply stripped of managers. The danger emerges when companies remove managerial layers without rebuilding accountability systems. Middle managers often function as risk buffers, mentors, and culture stabilizers. Hierarchy compression without process redesign frequently produces burnout, misalignment, and operational chaos.

Firms compress management structures to reduce overhead and speed execution by replacing human coordination with automated reporting, planning, and performance systems. This shows up most strongly in corporate operations, project management, and administrative leadership layers. Beneath the narrative of agility lies a deeper restructuring of accountability, with fewer humans responsible for broader scopes of work. The market messaging emphasizes “leaner organizations” and “empowered teams,” while the real effect is workforce compression in mid-level management. The impact on layoffs is medium to high, and the future of work becomes flatter, faster, but often more strained.

Meta is a textbook case of layer-compression framed as efficiency, with Zuckerberg describing a “humbling wake-up call” and confirming layoffs alongside budget and footprint reductions. In banking, Citigroup has framed large-scale reductions as structural modernization, with its CEO pointing directly to automation and AI changing how work is done across the bank, accelerating job cuts in roles that become redundant in redesigned workflows. Key takeaway: De-layering is often sold as speed, but it is fundamentally a redesign of accountability. The success claim tends to be faster decisions and lower overhead; the risk is weaker mentoring, control, and execution coherence.

This theme is low-to-moderately bubble-prone because (i) coordination automation can deliver genuine speed and cost improvements, but (ii) companies often market de-layering as an “AI transformation” even when it is a classic overhead reduction move, and (iii) the capital behavior here is less about speculative AI investment and more about short-term margin management. Bubble risk rises only when firms claim AI has replaced management while actually degrading execution quality.

Viewed through the lens of bubble dynamics, this theme mainly touches a restructuring bubble because the change is behavioral and organizational rather than capital-intensive. The technology expectation bubble appears when firms claim AI can replace management functions wholesale, when in reality it often replaces reporting and coordination, not leadership. A productivity perception bubble also appears if companies assume flatter equals faster without redesigning decision rights, incentives, and escalation paths. The market loves “agility” language, but agility without governance becomes fragility. The future-of-work impact is medium-high due to pressure on mid-level roles.

3) AI Replacing Routine Task Clusters Rather Than Entire Job Roles

Automation doesn’t replace workers all at once. It starts by removing the routine.

Most roles consist of multiple task categories, and AI excels at repetitive documentation, pattern recognition, basic coding, data summarization, and standardized responses. Organizations are now eliminating positions heavily weighted toward these automatable task bundles. Where 60 to 80 percent of daily work is routine and rule-based, restructuring around smaller, higher-value human teams is economically rational. OHK observes that the most successful transformations clearly separate automatable workflows from judgment-driven responsibilities. Problems arise when firms equate automatable tasks with automatable jobs. Humans still provide accountability, contextual reasoning, ethical judgment, and creative synthesis. Over-automation often produces hidden failure costs that only appear months later.

Companies target jobs where daily activities are heavily repetitive and rules-based, allowing AI to absorb large portions of work previously performed by junior staff and operations teams. This trend concentrates in analytics, documentation, coding support, content production, and service operations. The deeper reality is that entry-level career ladders are shrinking, reducing traditional training pipelines. Messaging focuses on “freeing employees for higher-value work,” but the immediate outcome is fewer total positions. The impact is high in early-career and routine knowledge roles, permanently altering workforce composition.

In consumer software, Intuit laid off 1,800 while simultaneously signaling a pivot to hire into roles aligned with AI priorities, explicitly reframing workforce mix toward AI-oriented capabilities. In education tech, Duolingo moved toward “AI-first,” and its CEO wrote, “Without AI, it would take us decades to scale our content…” while signaling the phase-out of contract work that AI can perform. Market message: “We’re upgrading the work.” What may really be going on: entry-level pathways shrink as routine task-bundles get automated first.

This theme is highly bubble-sensitive because (i) task automation is real and measurable in documentation, summarization, and routine knowledge work, but (ii) executives frequently overstate “job replacement” versus “task compression,” and (iii) the hype can drive overconfidence in downsizing decisions, producing skill bottlenecks and quality failures that only surface later. The bubble mechanism here is not valuations alone, but over-automation decisions driven by inflated expectations.

Examined from a bubble formation perspective, this theme hits a productivity perception bubble hard because it’s easy to confuse task automation with job elimination. The technology expectation bubble shows up when companies assume AI’s current competence covers edge cases, accountability, and quality control. It can also create a hiring bubble in reverse: firms cut juniors aggressively, then later scramble to hire experienced talent when pipelines collapse. The hidden bubble mechanism is overconfidence in substitution that isn’t operationally stable. Future-of-work impact is high because entry-level pathways and apprenticeship models shrink.

4) AI Redesigning Customer Service Around Intelligent Automation Engines and AI-Driven Services

As routine customer requests flow into automated systems, human service shifts toward the moments that require judgment, empathy, and complexity.

Customer support has become one of the fastest-automating domains as AI chatbots and virtual agents handle enormous interaction volumes. Organizations argue that automating tier-one inquiries such as password resets, order tracking, and basic troubleshooting allows human agents to focus on complex or emotionally sensitive cases. When implemented properly, AI can dramatically reduce response times while improving service consistency. OHK finds that high-performing firms reinvest automation savings into service quality rather than pure cost-cutting. The model fails when companies reduce headcount before AI performance reaches operational maturity. Poor automation frustrates customers, increases escalations, and erodes brand trust. Short-term payroll savings can quickly convert into long-term revenue loss.

Organizations adopt AI-driven customer service to handle high-volume interactions at minimal marginal cost, primarily in telecom, retail, finance, and digital platforms. What is actually occurring is the conversion of service labor into algorithmic throughput models where humans intervene only in exceptions. Companies communicate improved responsiveness and experience, while quietly optimizing payroll. The impact on layoffs is very high in frontline service functions, though the future of work shifts toward complex relationship management rather than volume handling.

Klarna published unusually concrete performance claims: its AI assistant handled two-thirds of customer service chats in its first month, positioning automation as both scale and service improvement. In banking, Bank of America has long used its virtual assistant Erica at scale and recently tied AI to major productivity gains, stating Erica has handled billions of interactions and performs work that would otherwise require thousands of employees, while also citing large internal developer productivity improvements. Bold reality: Customer operations is where AI substitution is most immediate, measurable, and layoff-exposed. The risk is service quality erosion if headcount drops faster than AI maturity.

This theme is low bubble risk and high real impact because (i) customer support automation is one of the most proven AI use cases with immediate volume-handling gains, (ii) the messaging generally matches reality because outcomes are visible to customers and measured in response times, and (iii) it does not require speculative capital narratives to justify itself since the ROI is often straightforward. The only bubble-like risk appears when firms cut too fast and then quietly absorb churn and customer dissatisfaction costs.

Assessing this theme through bubble behavior patterns, this theme is least “bubble-like” on technology feasibility because customer support is a proven domain for automation, so the technology expectation bubble is lower than in other themes. The main bubble risk is productivity perception, where companies extrapolate early improvements and cut too deeply before stabilization. An investment bubble can appear in large-scale customer platforms overspending on agent tooling and integration layers, but it is often tempered by measurable metrics like response time and resolution rates. This is a high-impact theme with relatively low hype risk when quality is measured.

5) Rebranding Technological Transformation And Using AI Narratives to Reframe Restructuring

When restructuring gets a new label.

Not every AI-linked layoff reflects genuine automation. In many cases, workforce reductions mirror classic cost-cutting cycles that are now framed as technological modernization. Markets often reward clear strategic storytelling, and positioning layoffs as part of an AI investment journey can project long-term vision. Narrative clarity can temporarily strengthen investor confidence. OHK sees this dynamic particularly in companies facing margin pressure where AI language softens traditional restructuring optics. The risk is credibility erosion. When layoffs are driven primarily by demand slowdown or financial engineering, blaming AI obscures real business issues. Narrative drift eventually collides with operational reality.

Some firms use AI narratives to reposition standard cost-cutting measures as strategic modernization, particularly during economic slowdowns or margin pressure. This occurs broadly across sectors under investor scrutiny. Beneath the innovation language lies conventional expense reduction rather than genuine automation redesign. Market communication stresses “AI investment journeys,” while the real activity mirrors historical restructuring cycles. The direct technological impact is low, but layoffs are high because financial pressure, not automation, is driving decisions.

A current example is Dow, which announced about 4,500 job cuts while explicitly citing a shift toward AI and automation, packaging cost and restructuring as tech-enabled transformation. Another is Pinterest, where layoffs were reported alongside an “AI-focused” strategic direction, reflecting the broader dynamic of workforce cuts being narrated as repositioning for AI-era competition. OHK-style takeaway: When AI becomes the headline explanation, it can obscure older drivers like margin pressure, competition, or post-hiring correction.

This theme is the most bubble-fueling of all because (i) the operational value is often minimal when AI is mainly a communications wrapper, (ii) the narrative-to-reality gap is structurally large since cost cuts are presented as “AI modernization,” and (iii) it encourages capital markets to price “AI leadership” based on language rather than execution. If there is a bubble component in the layoffs story, it is concentrated here, where messaging becomes the product.

Analyzing how this force intersects with emerging bubble dynamics, this theme is the most bubble-intensive because it directly manufactures a technology expectation bubble and asset price bubble potential through messaging. It also fuels a restructuring bubble: layoffs happen because “AI transformation” is the story that markets reward, not necessarily because automation is ready. A productivity perception bubble follows when firms claim efficiency gains without proof. This is where “AI-washing” becomes a mechanism of bubble formation. The future-of-work effect is confusing: layoffs rise, but genuine redesign may be minimal.

6) AI Driving Workforce Recalibration and Accelerating Post-Pandemic Overhiring Corrections

The post-expansion workplace, where growth has been swept away and a new normal takes shape.

Many organizations expanded aggressively during 2020–2022 under inflated growth expectations. As demand normalized, layoffs became inevitable. AI arrived precisely as companies needed to recalibrate workforce size. Used wisely, this correction period becomes an opportunity to redesign workflows around automation rather than simply shrinking back to old structures. OHK finds that firms integrating automation during downsizing achieve stronger long-term efficiency gains. The danger lies in executives treating cyclical corrections as technological inevitability, avoiding accountability for strategic misjudgments. AI should not become a convenient scapegoat for overexpansion.

After pandemic-era hiring surges, companies now downsize while embedding automation to ensure they do not return to previous staffing levels. This is most visible in technology, e-commerce, logistics, and professional services. The underlying shift is structural workforce rebasing rather than short-term correction. Public messaging frames this as operational discipline and technological evolution. The impact on layoffs is high in the short term and medium long-term, permanently reducing baseline headcount.

In enterprise software, Microsoft has continued layoffs while analysts note the surrounding context is cost control and margin management amid heavy AI-related data-center investment, meaning AI can be adjacent to layoffs even when not the direct “replacer” of roles. In HR software, Workday cut about 400 roles while emphasizing realignment to priorities and continued hiring in strategic areas, with coverage explicitly connecting the environment to the AI-driven reset in how software firms defend margins and growth narratives. Key market signal: “We’re reallocating to AI priorities.” What may really be happening: correction + rebasing, with AI acting as the justification lens.

This theme is moderately bubble-prone because (i) some firms genuinely embed automation while resizing, but (ii) many use AI as a convenient frame for a correction that would have happened anyway, and (iii) investor enthusiasm can reward the AI narrative even when the underlying driver is cyclical. The bubble risk is that companies treat a normal correction as proof of AI substitution, building exaggerated expectations into future guidance.

Considering the bubble pressures shaping this dynamic, this theme touches a hiring bubble first (the 2020–2022 expansion) and then transitions into a restructuring bubble if layoffs become faster than validated automation gains. It also creates a productivity perception bubble when executives retroactively attribute the correction to AI rather than demand normalization. A mild technology expectation bubble appears when firms suggest that AI makes prior headcount structurally unnecessary across the board. The key risk is misattribution: AI becomes the storyline for a cyclical correction.

The future of work is increasingly divided by leverage as routine work flows downward, opportunity concentrates among the few whose skills scale with intelligent systems.

7) AI Polarizing Skills and Employment and Concentrating Investment in High-Leverage Digital Skills Versus Routine Roles

Demand for AI engineers, data scientists, cybersecurity experts, system integrators, and digital product leaders is surging, while demand for routine coordination and execution roles is shrinking. High-leverage digital skills now generate exponentially higher output per employee. OHK observes that organizations naturally funnel resources toward these capabilities. However, without structured retraining pathways, firms risk hollowing out institutional knowledge and operational continuity. Skill polarization without reskilling strategies creates long-term talent fragility and social backlash.

Firms increasingly concentrate resources on scarce AI, cybersecurity, and data capabilities while reducing routine operational roles. This occurs across nearly all knowledge-driven sectors. The deeper reality is an economic bifurcation of labor markets into highly paid specialists and shrinking mid-skill positions. Companies communicate “upskilling initiatives,” but rehiring rarely matches displacement volumes. The impact on future workforce inequality is high, with sustained layoffs in generalist functions.

A clear example is Shopify, where CEO Tobi Lütke told teams they must demonstrate why AI cannot do a job before requesting additional headcount, effectively making “AI-first” capability a hiring gate and signaling that routine roles will shrink while high-leverage digital skills expand. A second example is IBM, whose CEO Arvind Krishna publicly argued that AI could take on roughly 30–50% of repetitive office tasks, reinforcing a strategy of slowing or shifting hiring in roles dominated by routine work while concentrating investment in scarce skills such as AI engineering, automation, and system integration. Key market message: “We are upgrading the workforce toward high-leverage capabilities.” What may really be happening: the middle of the labor market is being compressed faster than reskilling pipelines can rebuild it.

This theme carries medium bubble risk because (i) demand for AI-adjacent skills is real and persistent, but (ii) many firms overstate “reskilling” while cutting broad mid-skill roles faster than they create new pathways, and (iii) the capital impact shows up as wage inflation and talent bidding wars that can resemble a mini-bubble inside the labor market. When hiring becomes “AI theater” rather than capability building, the bubble expands.

Looking through the bubble lens, this theme touches a labor-market hiring bubble in AI talent: wage inflation, bidding wars, and over-hiring of scarce profiles based on projected demand rather than proven utilization. It also creates a technology expectation bubble if firms assume hiring AI talent alone guarantees transformation. A productivity perception bubble can emerge when organizations announce “AI teams” and assume productivity improvements will follow automatically. The bubble is often localized: not in total headcount, but in a narrow band of expensive skills.

As intelligent systems consolidate oversight, sprawling compliance work quietly compresses into single points of control and departments can fit behind one dashboard.

8) AI Compressing Compliance Operations and Automating Risk Management and Control Functions

Organizations increasingly deploy AI to monitor fraud, detect anomalies, enforce policies, and standardize compliance processes at scale. Where rule-based decisions dominate, automation can significantly reduce human error and processing cost. OHK finds strong productivity gains in financial operations and regulatory monitoring. Yet AI introduces new exposures including algorithmic bias, explainability challenges, data leakage, and legal liability. Automation may shift risk rather than eliminate it if governance frameworks lag behind technology adoption.

Organizations automate monitoring, fraud detection, regulatory reporting, and control processes to scale governance cheaply. Financial services, healthcare administration, and industrial compliance functions are most affected. What actually happens is the replacement of large audit and control teams with smaller technical oversight groups. Messaging highlights safety and accuracy improvements. The impact is medium on layoffs but high on role transformation, shifting work toward system supervision.

In banking, Goldman Sachs is building AI “agents” with Anthropic to automate internal operational tasks like accounting, due diligence, and onboarding, with its CIO saying these agents will “considerably reduce the time required” for processes. The broader banking shift is reinforced by Goldman’s firmwide rollout of its AI assistant to support document summarization, drafting, and analysis, signaling AI’s arrival inside control-heavy functions. What may really be going on: compliance and operational risk teams are not eliminated first; they are restructured into smaller oversight groups supervising automated systems, which still changes headcount pressure over time.

This theme has low bubble risk because (i) the value proposition is concrete in fraud detection, anomaly monitoring, and operational controls, (ii) the messaging is usually cautious due to regulation and liability, and (iii) speculative capital behavior is constrained by governance requirements. The risk is less “bubble” and more “blind spot,” where firms underestimate new liabilities introduced by AI models.

Assessing this theme through bubble behavior patterns, this theme has low classic bubble behavior because regulatory constraints limit overclaiming, reducing the technology expectation bubble. The more relevant risk is a productivity perception bubble where firms believe automation reduces risk, while it may simply shift it into model risk, bias, and explainability issues. An investment bubble can appear in compliance tooling, vendor proliferation, and governance infrastructure, but it is usually disciplined by audits and supervisory scrutiny. The main danger is not hype; it’s false confidence. Future-of-work impact is medium: roles shift toward oversight and escalation.

From counting people to measuring impact—AI is shifting workforce economics from headcount to productivity per dollar invested.

9) AI Rewriting Labor Efficiency Economics and Replacing Headcount Metrics with Productivity-Per-Dollar Metrics

The traditional efficiency measure was cost per employee. The emerging metric is output generated per dollar invested across people and technology combined. When AI meaningfully multiplies throughput, fewer employees can produce far greater economic value. OHK observes that high-performing firms rigorously track workflow productivity rather than focusing solely on payroll reduction. The failure mode appears when layoffs precede productivity measurement. Cost reduction without output analytics often produces invisible bottlenecks and declining quality.

Companies adopt productivity-per-dollar metrics enabled by AI-driven throughput measurement. This trend appears in software development, operations, marketing, and analytics. The real shift is economic rationalization of every role based on measurable contribution. Executives present this as “efficiency culture,” while workforce trimming becomes continuous rather than episodic. The impact on layoffs is medium but persistent, embedding constant optimization into work life.

In industrial operations, GE has long marketed AI-enabled predictive services as delivering reduced downtime and improved maintenance planning, reflecting the shift from staffing levels to outcomes and throughput as the primary performance yardstick. In software delivery more broadly, Bain’s 2025 research reflects what many firms are now claiming internally: AI assistants deliver measurable productivity gains (often 10–15%) even when organizations struggle to convert saved time into higher-value work. Bold takeaway: The “productivity story” is real, but many companies cannot yet prove it cleanly enough to justify permanent workforce compression without quality loss.

This theme is highly bubble-prone in narrative form because (i) AI productivity improvements exist but vary widely, (ii) organizations often market productivity gains before they can measure them rigorously, and (iii) capital markets may reward margin expansion stories without demanding proof, incentivizing premature headcount cuts. A productivity narrative without measurement is one of the most reliable fuel sources for an AI bubble.

The bubble lens examination of this theme shows that it directly creates a productivity perception bubble because it replaces “how many people” with “how much output,” but many firms cannot measure output rigorously. The technology expectation bubble appears when leaders assume AI productivity gains are stable, transferable, and permanent. It can also trigger a restructuring bubble as organizations continuously “optimize” headcount based on assumed productivity multipliers. The bubble fuel here is weak measurement: when metrics are fuzzy, narratives fill the gap. Future-of-work impact is medium-high, shifting toward instrumented, quantified performance regimes.

When strategy becomes a signal, markets rise and chairs quietly disappear.

10) Stock-Market “AI Signaling” and Aligning Workforce Restructuring with Capital Market Incentives for Efficiency and Technology Leadership

Investors increasingly reward lean operations, margin expansion, and visible AI strategies. Layoffs paired with automation investment frequently trigger positive market reactions. Capital markets currently interpret workforce compression as a signal of operational discipline and technological modernization. OHK finds this incentive strongly shapes executive behavior. The risk is short-term optimization that undermines innovation capacity, resilience, and customer experience. Financial engineering rebranded as AI transformation eventually repeats old mistakes.

Public markets increasingly reward visible automation strategies combined with cost discipline. Executives therefore integrate layoffs into modernization stories to signal operational sophistication. This behavior appears most strongly in publicly traded firms under margin pressure. The deeper reality is incentive alignment between executive compensation, market sentiment, and workforce compression. The impact on layoffs is high where shareholder pressure dominates strategy, regardless of actual automation maturity.

A strong illustration is UPS, where large job reductions and facility closures were linked to reshaping the business mix toward higher-margin deliveries; importantly, the company’s stock reaction underscores how markets reward “discipline + strategy,” even when the driver is not purely AI. Another is Amazon, which has appeared repeatedly in layoff tallies and has framed reductions alongside AI-driven restructuring, feeding the market perception that job cuts can indicate modernization rather than distress. What the messaging does: it turns layoffs into a “directional signal” to investors. What may really be going on: a blend of margin defense, capex shift, and narrative positioning.

This theme is direct bubble fuel because (i) the operational changes may be real or mixed, but (ii) the signaling effect can dominate reality as companies learn that announcing “AI transformation + layoffs” is interpreted as discipline and modernization, and (iii) this creates feedback loops where market rewards encourage more narrative-driven restructuring. When stock pricing is driven by AI signaling rather than operational results, bubble dynamics become systemic.

Viewed through the lens of bubble dynamics, this theme is the clearest bridge from operating decisions to asset price bubbles because layoffs plus “AI strategy” often become a market signal. It also fuels a restructuring bubble: organizations may cut faster to show discipline and modernization. A technology expectation bubble emerges when “AI leadership” is treated as a valuation driver even before results are proven. The bubble mechanism is incentive alignment: executives, analysts, and investors share the same narrative rewards. The future-of-work impact is high where public market pressure is strongest.

When perception lifts faster than performance, bubbles begin to shape the future of work. Some transformations rise on solid foundations, others float on expectations waiting to be tested.

Bubble Interrelationships in AI: How Narrative, Markets, and Organizational Change Reinforce Each Other

Across all themes, OHK finds that bubble dynamics rarely operate in isolation. Instead, restructuring behavior, technology expectations, productivity perceptions, hiring patterns, and capital market incentives frequently interact in reinforcing loops that can accelerate workforce compression beyond what operational reality alone would justify.

In many organizations, restructuring bubbles emerge independently of financial markets. Firms experiencing internal cost pressure, post-expansion corrections, or peer benchmarking often pursue rapid de-layering, automation, and workforce compression even when valuations are flat or declining. Here, the driver is organizational behavior rather than investor exuberance. Execution risk builds quietly as accountability thins, training pipelines shrink, and institutional knowledge erodes, creating what OHK refers to as “internal execution debt.” Corrections in these cases tend to surface operationally first, through quality failures, employee burnout, customer dissatisfaction, or the need for rehiring long before stock prices react.

However, when capital markets are simultaneously optimistic about AI-driven efficiency, these organizational dynamics frequently lock into asset price bubbles. Markets reward visible “AI transformation” signals, including layoffs paired with automation investment narratives. Executives, responding to both compensation incentives and peer behavior, accelerate restructuring to demonstrate discipline and modernization. This coupling creates classic feedback loops: narrative optimism drives restructuring; restructuring validates the narrative; market rewards reinforce both. In these environments, workforce compression can proceed faster than productivity gains materialize, amplifying bubble risk.

The relationship is not uniform across sectors. In customer-facing domains such as service operations, reality acts as a rapid corrective mechanism. If automation degrades customer experience, churn and reputational damage quickly force operational adjustments, limiting how long restructuring bubbles can persist without genuine performance gains. Here, bubble behavior tends to be short-lived and self-correcting.

In contrast, knowledge work, management layers, productivity metrics, and talent restructuring allow bubbles to persist longer because quality erosion and execution risk surface slowly. Firms can claim efficiency gains while defects, compliance exposure, burnout, and skill shortages accumulate invisibly. These areas are particularly prone to productivity perception bubbles, where assumed gains precede measurable outcomes, and technology expectation bubbles, where AI’s current limitations are discounted.

Hiring dynamics further complicate the picture. In some cases, hiring bubbles in scarce AI skills inflate wages and overinvestment in specialist talent even when overall headcount shrinks. This often couples with restructuring bubbles in the broader workforce, as generalist and mid-skill roles are cut to fund expensive technical hires. Strategic fear and competitive imitation can sustain this behavior regardless of market valuation, though asset bubbles intensify it by rewarding visible AI leadership signaling.

Regulated and compliance-heavy sectors behave differently. Governance constraints tend to dampen classic bubble behavior, limiting overclaiming and speculative restructuring. However, even here, mild restructuring bubbles can appear when firms frame automation as a cost lever rather than a risk management upgrade. Corrections in these environments are usually sharp and externally imposed through regulatory intervention rather than gradual operational decline.

The most powerful coupling occurs when capital market signaling bubbles dominate. When valuation responds more to transformation narratives than to measurable outcomes, restructuring becomes performative. Layoffs turn into strategic signals rather than operational tools. Firms repeat what markets reward, peers imitate successful narratives, and bubble dynamics spread systemically across industries. In these phases, workforce compression accelerates regardless of whether automation is delivering sustainable productivity.

Ultimately, OHK finds that bubble dynamics follow a consistent pattern: perception precedes reality, narrative drives action, and corrections arrive when operational fundamentals can no longer support the story. Where performance metrics are strong and feedback is immediate, bubbles collapse quickly. Where measurement is weak and consequences are delayed, bubbles persist longer and grow larger.

Understanding these interrelationships is critical for interpreting AI-era layoffs. Workforce reductions may reflect genuine transformation, cyclical correction, narrative signaling, or some combination of all three. The future of work will be shaped not only by what AI can technically automate, but by how organizational incentives, market expectations, and human behavior interact to accelerate or restrain change.

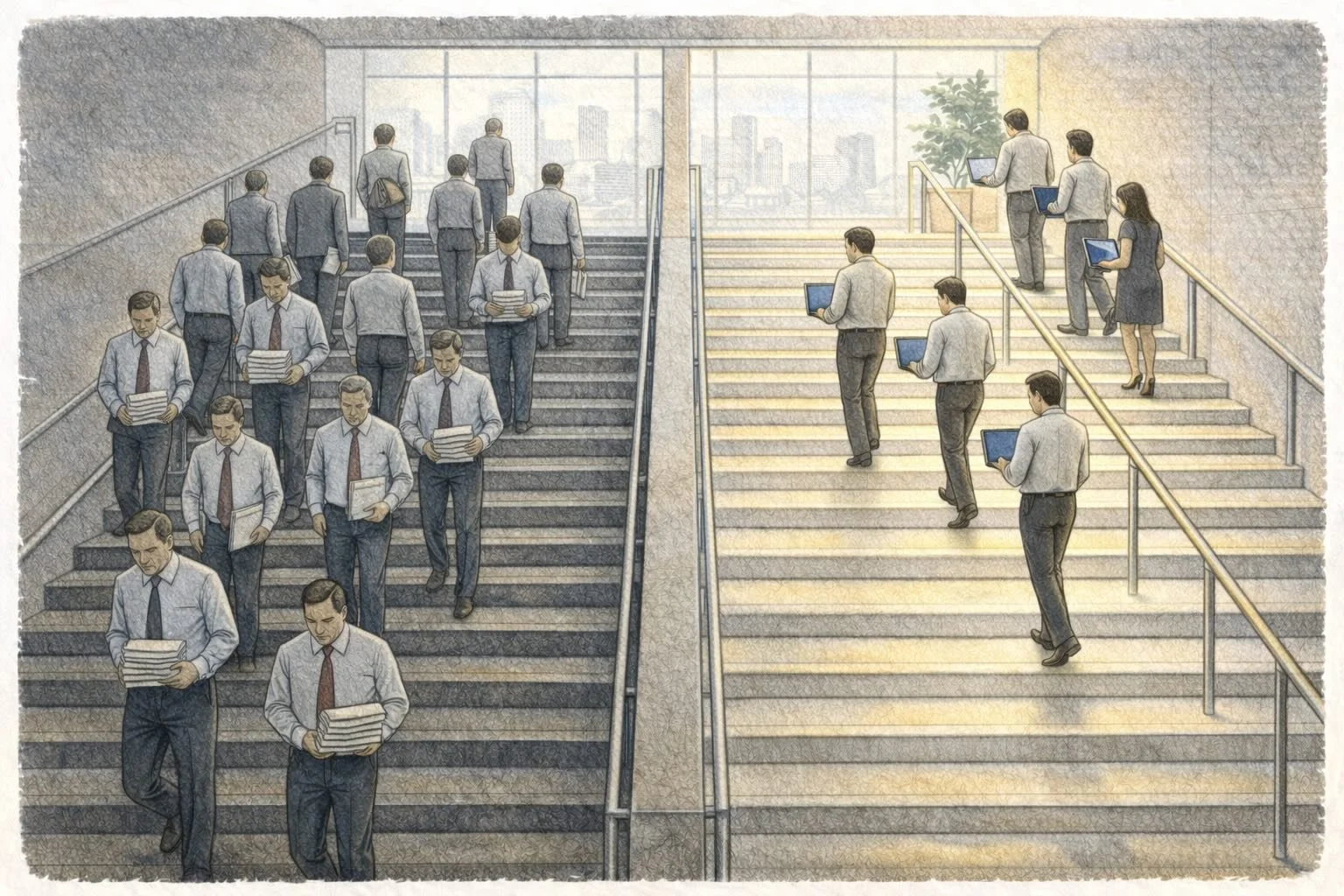

From the old world of work to the new where human effort and intelligent systems begin to converge. The future of work is not a break from the past, but a gradual crossing into a redesigned world.

What We Reveal About the Future of Work?

As organizations race to integrate artificial intelligence into their operating models, workforce reductions have become the most visible—and often most misunderstood—signal of transformation. Yet beneath headline job cuts lie deeper structural shifts in how work is designed, value is created, and productivity is measured. The following lessons distill what AI-era layoffs are truly revealing about the future of work, separating sustainable automation-driven progress from narrative-led restructuring. Together, they offer leaders, investors, and policymakers practical frameworks for evaluating when workforce compression reflects real transformation, when it signals emerging risk, and how organizations can navigate technological change without undermining long-term resilience.

Lesson 1: When Do AI-Era Layoffs Actually Make Economic Sense? A practical way to evaluate workforce reductions is through two core lenses. The first asks how “automatable” the underlying work truly is, with routine processing, standardized analysis, and predictable interactions offering high automation potential, while strategic judgment, relationship management, creative synthesis, and accountability remain low-automation domains. The second asks how risky it is to remove human oversight, where repetitive rule-based tasks carry low execution risk, but compliance, safety, trust, and complex problem solving remain high-risk areas.

Layoffs are economically rational primarily when AI potential is high and execution risk is low. When both are high, workforce cuts are usually reckless.

Taken together, the lessons from the AI layoff cycle point to five core realities shaping the future of work: (i) workforce reductions create lasting value only when automation potential is genuinely high and execution risk is low; (ii) genuine transformation consistently produces measurable operational improvements rather than simply lower payrolls; (iii) artificial intelligence is fundamentally reorganizing how work is structured rather than eliminating human contribution altogether; (iv) narrative-driven restructuring can accelerate layoffs beyond what real productivity gains justify, creating correction risk; and (v) organizations that thoughtfully redesign workflows, invest in skills, and preserve human judgment where it matters will outperform those that treat AI primarily as a cost-cutting tool.

Lesson 2: Proof That Layoffs Reflect Real Transformation Rather Than Cost-Cutting. OHK consistently finds that genuine AI-driven restructuring produces clear operational fingerprints rather than simply lower payrolls. Organizations undergoing real transformation reinvest aggressively in technology infrastructure immediately following workforce reductions, redirect hiring toward high-leverage technical and product roles, and redesign workflows end-to-end rather than trimming headcount within legacy processes. These shifts are accompanied by measurable improvements in service quality, productivity, and operational cycle times, as well as stable or improving engagement among remaining employees. When these indicators are absent, layoffs almost always reflect traditional cost-cutting rather than operating-model transformation.

OHK’s analysis shows that successful AI-driven restructuring is visible in operations within months, not promised in strategy decks over years.

Taken together, these patterns reveal five core signals of authentic transformation: (i) sustained post-layoff investment in AI and automation infrastructure; (ii) targeted hiring into high-impact digital and systems roles; (iii) documented workflow redesign rather than simple workforce compression; (iv) measurable performance improvements within quarters rather than years; and (v) organizational stability reflected in engagement, retention, and execution quality.

Lesson 3: The Bigger Picture: AI Is Reorganizing Work, Not Eliminating It. Every major technological shift has destroyed certain jobs while creating new industries. The Industrial Revolution eliminated manual labor roles but built modern manufacturing economies. Computers removed clerical work but created digital services. AI will follow this pattern, but at unprecedented speed. The real danger is not job loss itself, but unmanaged transition. Poorly designed automation produces fragile systems, knowledge erosion, social instability, and regulatory backlash. Well-designed integration generates productivity, new roles, better services, and economic expansion. Layoffs are simply the blunt instrument through which this transformation is currently unfolding.

OHK finds that organizations treating layoffs as the strategy rather than the transition tool consistently underperform those redesigning work around human judgment and intelligent systems together.

Taken together, the historical and current evidence points to five enduring realities: (i) technological progress consistently reshapes work rather than eliminates it wholesale; (ii) productivity gains emerge when automation is paired with organizational redesign; (iii) unmanaged transitions amplify social and operational risk; (iv) well-governed integration unlocks new economic value and employment categories; and (v) workforce reductions are transitional tools rather than endpoints of technological change.

Transformation happens at the system level—where humans and automation meet in the new operating model.

Conclusion: A New Signal—But Not Always a Smart One

Layoffs once signaled business distress. Today, they increasingly signal organizational redesign around intelligent systems. In some cases, this shift reflects genuine productivity transformation. In others, it is accelerated by narrative momentum, market incentives, and optimistic assumptions about what automation can replace. The danger is not AI itself, but unmanaged and hype-driven restructuring that compresses work faster than operating models can adapt.

The organizations that will thrive in the AI era will not be those that cut fastest, but those that redesign work most intelligently, measure productivity rigorously, preserve human judgment where it matters, and integrate automation where it truly adds leverage. AI is not a cost-cutting tool. It is an operating-model revolution—and layoffs are merely its most visible, and often crudest, expression.

Where Do We Go From Here?

Part I established the structural foundation of the AI-driven future of work, identifying the ten strategic forces reshaping organizations and explaining how layoffs have evolved from reactive cost controls into signals of operating-model redesign, while introducing the bubble dynamics that can accelerate or distort this transformation. Building on this framework, Part II builds directly on this framework by examining where these forces land most heavily across sectors and national economies, revealing which industries experience deep automation-driven disruption, which remain relatively insulated due to human experience and service intensity, and how emerging markets and labor structures shape impact differently. Going further, Part III then integrates both perspectives into a quantitative analytical framework, translating strategic forces and sectoral exposure into measurable automation risk, productivity shifts, and workforce transformation trajectories, allowing organizations to assess not only where AI will reshape work, but at what speed, scale, and sustainability.

This article is part of OHK’s ongoing series on artificial intelligence broadly and the future of work specifically, examining how AI is reshaping organizations, economies, and operating models across industries.

At OHK, our work on the future of work and AI-driven transformation is grounded in real-world organizational redesign, not abstract technology forecasts. We support governments, development institutions, and private-sector leaders in translating artificial intelligence into sustainable operating models that improve productivity while preserving execution resilience, workforce stability, and social legitimacy. From workforce transformation strategies and automation roadmaps to productivity measurement frameworks and policy-ready labor transition planning, we help organizations distinguish genuine AI-driven modernization from narrative-led restructuring that risks long-term correction. Our hybrid expertise across management consulting, economic planning, and international development enables us to design transformation programs that integrate technology deployment with governance capacity, skills development, and institutional reform. If your organization is navigating AI adoption, workforce restructuring, or future-of-work strategy, contact us; OHK can support you in building automation responsibly, measuring impact rigorously, and redesigning work for long-term value creation rather than short-term cost compression.